As a healthcare Group with more than 190,000 employees, Fresenius plays an important role in society. For more than 100 years, our motivation has been to preserve life, promote health, and improve the quality of life for people who are ill.

We aim to provide innovative products and services, and work proactively to enable a growing number of people to have access to high-quality, affordable healthcare. Our common goal is to improve healthcare quality and efficiency. The well-being of patients is always our top priority. It is our point of reference for all our business decisions.

For Fresenius, economic success is not an end in itself, but a means of continuously investing in medical progress and thus creating added value for society.

The business model

Fresenius is a global healthcare Group and one of the leading companies in its respective markets. The Fresenius Group comprises three independently operating, fully consolidated business segments, managed by Fresenius SE & Co. KGaA as the operationally active Group holding company: Fresenius Kabi specializes in products for the treatment and care of critically and chronically ill patients. Fresenius Helios is Europe’s leading private healthcare provider. The company includes Helios Germany and Helios Spain, the largest hospital operators in their respective home markets, as well as the Eugin Group, which was sold on January 31, 2024. Fresenius Vamed delivers projects and services to hospitals and other healthcare facilities internationally and is a leading post-acute provider in Central Europe. The Corporate / Other segment comprises the holding functions of Fresenius SE & Co. KGaA and Fresenius Digital Technology GmbH, which provides information technology services. The Group Management Report contains additional information on the Group’s business model and ownership structure, in particular on legal and economic factors as well as key sales markets and competitive positions.

Healthcare markets

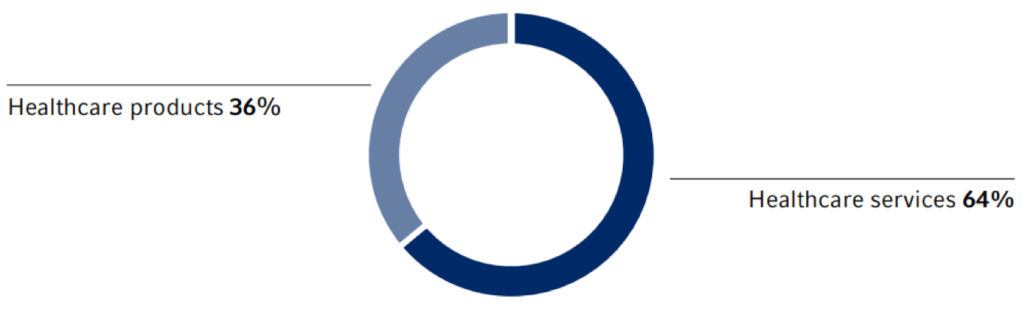

The business activities of the Fresenius Group are divided into the market segments healthcare products (Fresenius Kabi) and healthcare services (Fresenius Helios and Fresenius Vamed). The majority of revenue (around 64%) is attributable to the area of healthcare services in the context of patient care in the healthcare facilities of Fresenius Helios and Fresenius Vamed. In the area of healthcare products, Fresenius Kabi offers innovative solutions for critically and chronically ill patients.

Revenue by market segment 2023

Download(XLS, 35 KB)| in % | Fresenius Kabi | Fresenius Helios | Fresenius Vamed |

|---|---|---|---|

| Share of Group revenue | 36 | 55 | 9 |

| Thereof healthcare services | 0 | 100 | 100 |

| Thereof healthcare products | 100 | 0 | 0 |

Group Revenue Split 2023

Material topics are presented as Group approaches. Further, the material topics are presented by market segment, if their specific business activities require this. Information on the Fresenius Helios business segment includes all operating and administrative units of the business segment, unless otherwise stated. This allows us to emphasize country-specific market conditions.

In February 2023, Fresenius announced its intention to work towards a change in the legal form of Fresenius Medical Care AG & Co. KGaA to a stock corporation and to deconsolidate the business segment in this way. On July 14, 2023, an Extraordinary General Meeting of Fresenius Medical Care AG & Co. KGaA approved the change of legal form to a stock corporation. Since the financial statement for the third quarter of 2023, Fresenius Medical Care has therefore no longer been included in the reporting on the operating activities. On November 30, 2023, the change of legal form of Fresenius Medical Care to a stock corporation became effective.

Further details can be found on pages 272 ff. in the Notes to the Consolidated financial statements. Further changes in the scope of consolidation of Fresenius SE & Co. KGaA's scope of consolidation in the fiscal year 2023 are explained in the Group Management Report in the section Investment and acquisitions and in the section Acquisitions, divestments and investments starting on page 292 of the Notes to the Consolidated Financial Statements.

With the announcement of the change in legal form in February 2023, steps were also taken to structurally implement the separation of the business segment of the Group. However, due to the stock exchange listing of both Fresenius and Fresenius Medical Care, both companies were already subject to strict requirements before the change of legal form, particularly in the area of compliance, and were highly independent. To improve transparency for our stakeholders, both the historical ESG (Environment, Social, Governance) reporting data and the figures for 2023 within this report have been adjusted for the corresponding data from Fresenius Medical Care. Furthermore, the change of legal form and deconsolidation have not changed the material topics for ESG reporting. The management approaches to these material topics are also not affected, as Fresenius Medical Care pursued its own governance approach in each case even before the change of legal form. Where Group approaches are described, they relate to the operating units of the business segments Fresenius Kabi, Fresenius Helios, and Fresenius Vamed, and the corporate functions of Fresenius SE & Co. KGaA.

Fresenius Medical Care publishes an Annual Report as well as a separate Non-financial Group Report. Further information can be found on the company’s website: www.freseniusmedicalcare.com.

Guidelines and regulations

The Fresenius Group’s business activities are subject to a wide range of regulatory requirements. These are supplemented, for example, by internal guidelines, management manuals, and process documentation. For units that are subject to external certification, the catalog of requirements resulting from the respective certifications, e. g., ISO (International Organization for Standardization), JCI (Joint Commission International), or GMP (Good Manufacturing Practice), is applied accordingly. The internal processes and related documentation are continuously reviewed by the relevant specialist functions to determine whether an update to the internal guidelines is required due to changes in regulatory requirements or adjustments to the certification criteria. Where references to specific regulations are useful for a better understanding of the material topics, process, and reporting structures, these are listed in the Group Non-financial Report. A comprehensive list of all relevant regulations is not provided. The implementation and monitoring of compliance with relevant legal requirements and internal guidelines is within responsibility of the respective specialist functions.

Our ethical values go beyond legal requirements. For us, this means acting not only in accordance with the law, but also in accordance with applicable industry codes and our values. We are also guided by the following internationally recognized principles:

- Universal Declaration of Human Rights

- UN Guiding Principles on Business and Human Rights (UNGPs)

- International Labor Organization (ILO) Declaration on Fundamental Principles and Rights at Work

- OECD Guidelines for Multinational Enterprises

- German Corporate Governance Code

Key figures relevant to management and compensation

At Group level and at business segment level, various key performance indicators (KPIs) are used for the internal management and control of our key non-financial topics. If they are part of the remuneration of the Management Board, they are additionally explained in the Compensation Report. The Non-financial Report is audited with limited assurance, as explained in the independent practicioner’s report starting on page 201. Non-financial KPIs which are part of the remuneration of the Management Board, are additionally audited with reasonable assurance and are marked separately by footnote. In the Group Non-financial Report, additional key figures are reported that serve better understanding of the management approaches, control, or evaluation of the key non-financial topics. A comprehensive presentation of all internally recorded key figures is not intended.

Our value chain

Fresenius has subsidiaries in more than 60 countries, maintains an international distribution network and operates more than 50 production sites. In the Fresenius Group, all purchasing processes are managed by central coordination offices in the business segments. Competence teams pool requirements, conclude framework agreements, and constantly monitor current market and price developments. They also coordinate global procurement for individual production sites or healthcare facilities and initiate quality and safety checks on raw materials and procured goods.

In an environment characterized by ongoing cost-cutting efforts on the part of healthcare payers and price pressure in the revenue markets, security and quality of supply play an important role. We are therefore constantly optimizing our purchasing processes, standardizing procurement materials, tapping into new purchasing sources, and negotiating the best possible price agreements. In doing so, it is important to maintain a high degree of flexibility and to meet our strict quality and safety standards. A broad supplier portfolio reduces potential procurement or raw material bottlenecks in both the product and service business. Further information on this can be found in the Group Management Report.

Sustainability risks and controls

The identification and assessment of potential sustainability risks (non-financial risks) initially takes place at both Group level and in the three business segments as part of the risk management system. Sustainability risks are covered by the Fresenius Group’s existing risk catalogs and risk reporting.

As part of our risk management and the internal control cycle, key issues are regularly reviewed as described in the relevant sections of the Non-financial Report of the Fresenius Group. External partners, regulators, and internal audit experts conduct audits at least every two years, or more frequently. As explained in the Fresenius Group Opportunities and Risk Report, there were no deviations from the Group’s ethical standards in 2023. Information on audits can also be found in the respective chapters of this report.

As part of a Group-wide project to implement the requirements of the Corporate Sustainability Reporting Directive1 (CSRD), an analysis was also conducted in the 2023 reporting year to determine whether there are any further potential sustainability risks for material topics. Further information on this can be found in the Our materiality analysis section.

Overall, taking into account risk-mitigating measures (net risk assessment), we have not identified any material non-financial risks during the reporting period that are related to our business activities, business relationships, products, or services and that are very likely to have or will have a serious negative impact on the aforementioned non-financial aspects, or our business activities. The Group Management Report contains further information on opportunities and risks as well as a detailed presentation of the risk management and internal control system.

In addition to identifying potential risks, the responsible functions are also tasked with designing internal processes to ensure that business operations can be quickly resumed or, at best, not disrupted in the event of an incident. At Group level, the Corporate Business Continuity function is responsible for corporate security, corporate crisis management, and travel security worldwide. Due to the international nature of the Group and the wide range of security-related tasks, those responsible deal with issues relating to the continuation or resumption of business operations during or after crisis situations and also provide support in an operational context where necessary. Further information on business continuity is provided in the relevant chapters, if necessary.

1 The CSRD is an EU directive on sustainability reporting that requires companies within its scope to disclose their strategy, objectives, and measures on material sustainability issues in a comprehensive and detailed manner. It will replace the Non-Financial Reporting Directive (NFRD) in future and will come into force gradually from the 2024 fiscal year onwards.

Internal controls

The internal control system is an important component of Fresenius’ risk management. It covers all critical processes, such as financial reporting, quality and patient safety management, cybersecurity, data protection, and sustainability management. Fresenius has documented the corresponding key control objectives in a Group-wide framework, thus bringing together the various management systems in the internal control system in a holistic manner. Fresenius ensures the security and reliability of its processes with a large number of internal control measures, as well as their structured monitoring. Furthermore, the monitoring and evaluation by management help to ensure that process inherent risks are identified and that controls are in place to minimize these risks.

Internal Audit

The regular internal and external controls, analyses and quality audits by the responsible specialist functions, topic-specific management systems or external audit bodies are supplemented by the audit activities of the Internal Audit Group function. Its activities focus on increasing and protecting the corporate value of the Fresenius Group and improving Fresenius' business activities. To this end, Internal Audit conducts independent, objective audits to enhance the appropriateness and effectiveness of risk management, control and governance processes at all levels of the Group. Aspects such as ESG, cybersecurity and compliance are also taken into account in a risk-oriented manner.

In 2023, 36 audit engagements with different focus points and organizational topics were carried out. The audit results were analyzed by the responsible specialist functions and incorporated into the continuous improvement of existing measures.

If business segments conduct their own internal audits they review material topics, which is not under the control of the Group Internal Audit function. This encompasses, for example, audits of quality management provisions in the area of production.

Our sustainability goals and programs

Advancing patient care is key to our daily work. It inspires us in how we understand our social responsibility, and how to act responsibly. We want to make a difference in healthcare and thus drive changes for the benefit of people, especially our patients.

At the level of Fresenius SE & Co. KGaA and the three business segments, we therefore pursue specific sustainability goals, set ambitions, and implement corresponding sustainability projects. Progress is regularly reviewed and evaluated. From this, we determine the extent to which the targets can be further developed and optimized. Further details on the respective targets are explained in the following chapters.

In May 2023, the Fresenius Annual General Meeting approved the adjustment of the compensation system for the members of the Management Board of Fresenius Management SE. As part of the short-term variable compensation (short-term incentive – STI) with an assessment period of one year, ESG targets will continue to be included with a weighting of 15%. The focus here is on the areas of medical quality / patient satisfaction and employees. Medical quality / patient satisfaction is measured for the three business segments on the basis of different key figures. Further information on this can be found in the Patient and product safety section.

In the area of employees, employee satisfaction is measured on the basis of the Employee Engagement Index (EEI) for the Group. Further information on the EEI can be found in the Employees chapter.

ESG criteria account for 25% of the target achievement for the long-term variable remuneration of the Management Board (long-term incentive – LTI) with an assessment period of four years. ESG target achievement in the LTI is measured on the basis of CO2 reduction. The target corridor is aligned with Fresenius’ long-term goals of reducing its own direct (Scope 1) and indirect (Scope 2; market-based) CO2 emissions (calculated as CO2 equivalents) by 50% in total by 2030 (base year 2020) and achieving climate neutrality by 2040. Further information on our climate target can be found in the Environment chapter.

In the reporting year, not all ESG targets for the members of the Management Board were achieved. A detailed presentation can be found in the Compensation Report in the 2023 Annual Report. The ESG methodology for determining target achievement is published on the Fresenius SE & Co. KGaA website.

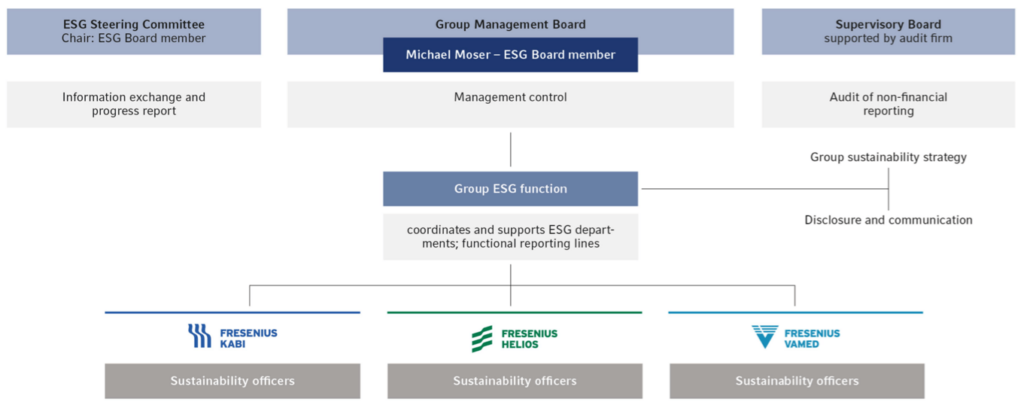

Our sustainability organization

Fresenius Management SE is the general partner of Fresenius SE & Co. KGaA. At Fresenius, sustainability was within the responsibility of the Chairman of the Management Board of Fresenius Management SE until June 30, 2023. The Group Management Board was informed about sustainability issues by the Investor Relations & Sustainability department at least monthly. Due to the increasing importance of sustainability, the organizational anchoring has been adjusted as of July 1, 2023. The Group Management Board member responsible for Legal, Compliance, Risk Management, ESG, Human Resources and for the business segment Fresenius Vamed (subsequently ESG Board member) has overall responsibility for sustainability. The topic of sustainability has been separated from the Investor Relations & Sustainability Group function and the Group ESG function has been established.

The Group ESG function acts as a competence center within the Fresenius Group. The function monitors regulatory developments, identifies key issues, and defines priorities and opportunities for the implementation of the ESG strategy. It supports Group-wide implementation and reviews progress as part of the annual reporting. Throughout the year, it aligns repeatedly with all Group functions and the ESG officers in the business segments to consider the respective business models and ensure the feasibility of measures. The Group ESG function is also responsible for internal and external stakeholder communication and, together with the Group Controlling function, for non-financial reporting.

The ESG Steering Committee, which was newly created at the end of 2023, consists of the ESG Board member (Chair), the Group ESG function, defined functions at Group level, and the ESG officers of the business segments. The committee will meet quarterly in the future starting in 2024 and will be tasked with providing information on current developments, deciding on appropriate measures to improve ESG performance, and monitoring the progress of implementation. The measures proposed by the ESG Steering Committee are submitted to the Fresenius Group Management Board for approval by the ESG Board member.

The Management Board and the Supervisory Board review the progress and results of sustainability management, which are then published in the separate Group Non-financial Report. The Supervisory Board is supported in this process by the audit performed by the external auditors. The key figures that form part of the remuneration components of the Executive Board are audited with reasonable assurance. The other key figures in the Group Non-financial Report and the report itself are subject to a limited assurance review. The Audit Committee of the Supervisory Board has special responsibility for reviewing the Group Non-financial Report. The Supervisory Board as a whole is also responsible for monitoring Fresenius’ sustainability performance. Changes in the committees are presented in the 2023 Annual Report in the corporate governance statement and in the overview of the boards on pages 369 ff.

Fresenius Group Sustainability Organization1

1 The overall structure shown in the graphic is valid as of January 1, 2024.

The departments and functions of Fresenius SE & Co. KGaA support the business segments in the development of guidelines and management concepts for the respective sustainability issues. The business segments have also each defined departments and persons responsible – often in the form of sustainability officers who coordinate all sustainability issues within the business segment.

Other committees at segment level are explained in the respective sections on governance structures in this report where applicable.

Contact

Fresenius SE & Co. KGaA

Group ESG

sustainability@fresenius.com