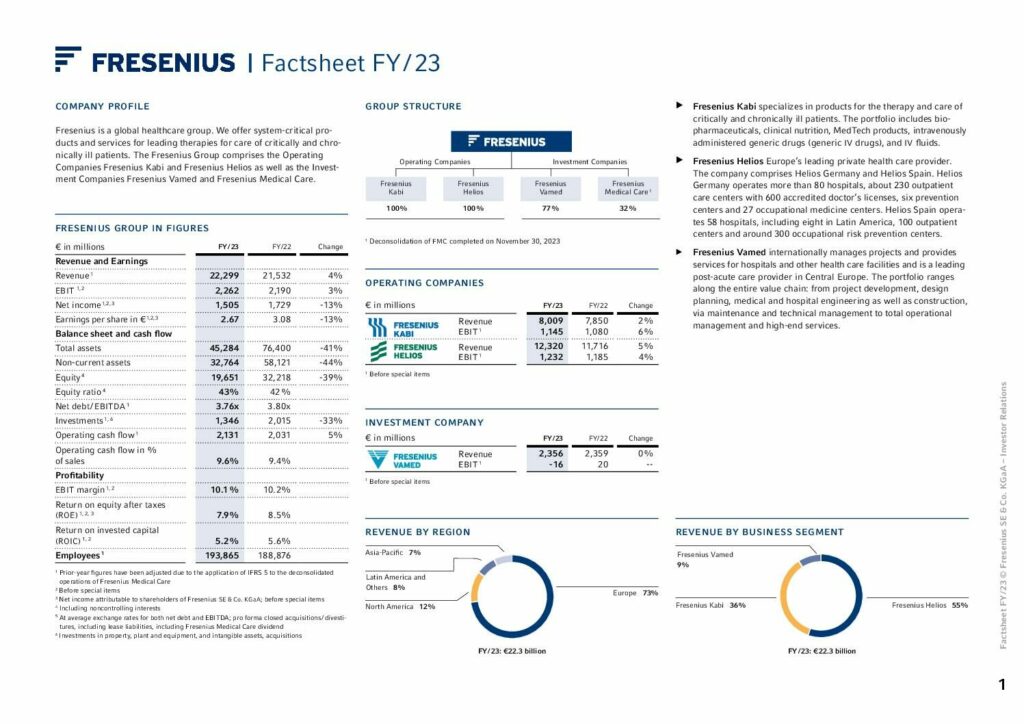

Financial Highlights

We achieved the raised outlook for 2023 and had a strong finish to the year with continued good development of our Operating Companies Fresenius Kabi and Fresenius Helios and progress in the turnaround of our Investment Company Fresenius Vamed.

To Group financial figures

1 Organic growth

2 Prior-year figures have been adjusted due to the application of IFRS 5 to the deconsolidated operations of Fresenius Medical Care.

3 Before special items

4 At constant currency

5 To show the underlying business development, the organic growth definition was adjusted to fully exclude the significant inflation accounting effects in Argentina.

6 From continued operations

Letter to our shareholders

For Fresenius, 2023 was a year of change and new beginnings. We successfully launched our #FutureFresenius corporate strategy and set the course for profitable growth.

Read moreNon-Financial Report

Consistent and strategic development of our ESG agenda is an integral part of #FutureFresenius. This is how we fulfill our corporate purpose of advancing patient care.

Read moreStrategy and management

Advancing patient care is key to our daily work. It inspires us in how we understand our social responsibility, and how to act responsibly.

Well-being of the patient

The well-being of patients is always our top priority. It is our point of reference for all business decisions.

Digital transformation

The rise of new technologies will leave a mark on future health delivery.

Employees

The commitment of our more than 190,000 employees worldwide forms the basis of our success.

Strategy

In the 2023 fiscal year, we successfully advanced our strategy #FutureFresenius in order to transform our Group and position it for the future.

Read more