GRI 205/103-1, 103-2, GRI 419/103-1

For Fresenius, compliance means doing the right thing. Our ethical values are based on more than just regulatory requirements, which means that we not only act in accordance with the law, but also according to applicable sector codices, our internal guidelines and values. For our employees, this is the foundation of all our activities. For our business partners and suppliers, it is the standard Fresenius sets for cooperation. In this way, we want to help ensure that everyone can rely on us as a partner of trust and integrity.

Our risk-based compliance management systems are aligned with the business of each of our business segments. Our key ambition is to prevent corruption and bribery in our business environment. Beyond that, prohibiting violations of antitrust law, data protection regulations, trade restrictions, and anti-money-laundering laws, preventing the financing of terrorism, and protecting human rights are also key areas, which we address with dedicated compliance measures.

Our approach

At Fresenius, we strongly believe that compliance protects what is most important to us: the well-being of the patients we care for. Compliance is firmly anchored in our corporate culture and guides us in our everyday work. Integrity, responsibility and reliability form the core of our understanding of compliance. Thereby, we design all our measures in such a way that they prevent compliance violations.

As stated in our Fresenius Code of Conduct, we are fully committed to adhering to statutory regulations, internal guidelines, and voluntary commitments, as well as acting in accordance with ethical standards. Violations are not to be tolerated. If a violation is detected, we perform an investigation, initiate the necessary remediation measures, and impose sanctions if applicable. In addition, incidents prompt us to anchor ethical and compliant behavior even more firmly in our corporate culture, as well as to further sharpen our compliance programs and prevention mechanisms in order to prevent future violations.

In all four business segments and at Fresenius SE & Co. KGaA, we have set up dedicated risk-oriented compliance management systems. These are based on three pillars: prevention, detection and response. Our compliance measures are primarily aimed at using preventive measures to avoid compliance violations. Key preventive measures include comprehensive risk identification and risk assessment, appropriate and comprehensive policies and processes, regular training, and ongoing consultation. We also carry out internal controls to identify possible compliance violations and ensure that we act in accordance with the rules.

The design and implementation of our compliance management systems are based on international regulations and guidelines, such as the ISO standards on the set-up of compliance management systems and applicable audit standards of the IDW (PS 980). When implementing measures, we take into account the respective national or international legal frameworks.

Organization and responsibilities

Involvement of the Management Board

Responsibility for compliance within the Fresenius Group lies with the Management Board and has been assigned to the board member responsible for Human Resources, Risk Management and Legal of Fresenius Management SE. The Management Board member assumed the function of Chief Compliance Officer of Fresenius SE & Co. KGaA until Dec. 31, 2021. As of Jan. 1, 2022, the new Group function Risk & Integrity was established, encompassing the areas Risk Management & ICS (Internal Control System), Business Integrity (formerly Corporate Compliance) and Data Protection. The Head of Business Integrity has assumed the functions and responsibilities of the Group Chief Compliance Officer of Fresenius Group. He has a direct reporting line to the Member of the Management Board, responsible for Human Resources, Risk Management and Legal.

In our four business segments, Chief Compliance Officers and in some instances Compliance Committees develop and monitor the respective compliance management system. These functions report to the respective management of the business segment.

The organizational structure

The business segments have established their own compliance organizations, which are based on the business organization. This includes respective Corporate Compliance departments, which develop global compliance initiatives for their business segment and support their respective compliance officers. More than 400 employees throughout the Group are responsible for compliance tasks and support Fresenius managers and employees in all compliance-related matters.

Corporate Compliance department of Fresenius SE & Co. KGaA

The Corporate Compliance department of Fresenius SE & Co. KGaA sets minimum standards for the compliance management systems, especially for those compliance risks that are relevant to all business segments. The department supports the compliance officers in the four business segments with standardized management tools, processes and methods, and develops overarching compliance initiatives with them.

Compliance Steering Committee

The Compliance Steering Committee (CSC) is the central advisory body of Fresenius SE & Co. KGaA for Corporate Compliance matters. The CSC is composed of the Chief Compliance Officer, the Chief Financial Officer, and the heads of the Legal, Internal Audit, and Corporate Compliance departments. If necessary, representatives of other governance departments attend the meetings of the CSC. The Compliance Steering Committee discusses the further development of the Compliance Management System, as well as important compliance initiatives and relevant compliance risk areas. The members of the committee also discuss severe compliance cases and their remediation. All four business segments report annually to the CSC on the progress of their compliance management systems. The meetings of the CSC take place every six to eight weeks. In 2021, eight meetings took place – due to the COVID-19 pandemic, most of them virtually.

Best practice exchanges and compliance expert panels

To ensure ethical conduct, we continually review our business practices and exchange on best practices with our compliance colleagues worldwide. Despite the travel restrictions that remained in place in 2021, regular exchanges in cross-divisional expert panels continued to take place within virtual meetings. Areas of collaboration included antitrust and foreign trade law, as well as anti-money laundering, whistleblower protection, and cross-border investigations.

Reporting structure

The Chief Compliance Officer of Fresenius SE & Co. KGaA is informed about initiatives driven by the Corporate Compliance department on a weekly basis. Compliance case reports of medium severity for the corporate segment are reported to the Chief Compliance Officer immediately. The Management Board of Fresenius Management SE receives reports on the corporate compliance management system’s status and selected initiatives regularly, at least twice a year. The Corporate Compliance department also prepares an annual compliance report, which provides a comprehensive overview of all Corporate Compliance initiatives. The Supervisory Boards of both Fresenius SE & Co. KGaA and Fresenius Management SE are regularly informed about progress of compliance measures, at least once a year, most recently in December 2021. The business segments have established individual reporting lines to their respective management. The management teams of the business segments receive regular reports on compliance by their Compliance Officers.

Despite the differences in business and risk profile in each business segment, we strive to uniformly evaluate the design of the compliance management systems. In 2021, aspects of the effectiveness of compliance measures were also surveyed after the Corporate Compliance department of Fresenius SE & Co. KGaA reviewed the maturity of the compliance measures of the business segments and Fresenius SE & Co. KGaA for all compliance risk areas by using the Compliance Management System Reporting methodology in the previous year. The results were presented to the Compliance Steering Committee as well as the Management Board and Supervisory Board. This assessment will be continued on a regular basis.

Guidelines and regulations

GRI 102-16, -17, -25

The Fresenius Code of Conduct forms the framework for all rules applicable in the Fresenius Group. The Code of Conduct lays out the principles of conduct for all employees, including managers at all levels and members of the Management Board. The Code is aligned with international regulations, as explained on this site, and was adopted by the Management Board of Fresenius Management SE. In addition, the four business segments have implemented their own Codes of Conduct, which reflect the Fresenius Code of Conduct principles and are adapted to the individual characteristics of each business segment. The Code of Conduct is available to all employees and is also available on the Internet. Guidelines, organizational directives, and process descriptions supplement and further define the rules of the Code of Conduct.

These are our principles, which are also defined in the Fresenius Code of Conduct:

- Ensuring quality of products and services.

The health of our patients depends on the quality of our products, services, and therapies. That’s why we are dedicated to providing the highest standards. Only high quality in medical care can ensure our economic success. At the same time, a company must be economically healthy in order to enable sustainable investment: in superbly qualified personnel, innovative therapies, and high-quality products. We do our part to improve the quality and efficiency of health care as a whole in all our business units. This enables us to make high-quality health care accessible to a steadily increasing number of people.

- Acting fair in competition

- Dealing properly with third parties

- Handling conflicts of interest transparently

- Acting in exemplary fashion

In more than 100 years Fresenius has evolved from a small pharmacy into a global health care Group. We act in a highly professional manner. At the same time, we remain down-to-earth. Commitment, honesty, and close contact with people are what distinguishes us: in the way we treat our employees, as well as our patients, business partners, and shareholders. Trust is a precious asset that we want to earn every day – through outstanding services as well as behaving with integrity. Therefore, we maintain high ethical standards and rules of good corporate governance that exceed the legal requirements.

- Protecting data

- Protecting company property

- Handling company information confidentially

- Living social responsibility

With our products and services, we make a decisive contribution to a future-oriented health care. We thereby focus not only on the present, but also on the long term. That is especially relevant for the development of better products and therapies. And for the responsible use of both natural and financial resources. We take great care in handling the funds from the healthcare sector and our investors. We make corporate decisions by exercising business prudence and with the aim of sustainable growth.

- Creating transparency in accounting, reporting, and communication with the public

Fresenius supplies essential pharmaceuticals and medical devices, offers vital healthcare services and also successfully and efficiently implements large-scale projects. In short: we are a reliable partner for healthcare systems worldwide. We make every effort to ensure the care of our patients. Supply and service capabilities are our first priority. And we find solutions where others do not. Reliability also results from our open and transparent communication. Our word is our bond. Our statements provide orientation. Patients, employees, business partners, and shareholders can be sure: we say what we do. And we do what we say.

Risk assessment

By using standardized methods, we regularly record, analyze, and evaluate compliance risks in each business segment and at Fresenius SE & Co. KGaA. These risk assessments cover over 20 risk groups depending on the business segment. Once a year, the compliance responsibles exchange information on key findings from the respective risk assessments. In addition to core compliance risks such as bribery and corruption, antitrust violations, money laundering, terrorism financing, data protection violations, trade restrictions, and human rights violations, the risk assessment also includes other significant business risks such as information security, environmental and occupational safety, quality assurance, and the protection of intellectual property, where the responsibility lies with other functions.

Dealing with third parties

Our Code of Conduct and the related guidelines for Fresenius Group employees also regulate our relations with business partners and suppliers. We expect them to comply with applicable laws and standards as well as ethical standards of conduct in daily business and have specified this in our Fresenius Code of Conduct for Business Partners. Our ambitions to avoid corruption and bribery are laid down in our Codes of Conduct. Among other topics, the Codes explicitly prohibit corruption and bribery and oblige our partners to comply with relevant national and international anti-corruption laws. In addition to risk-based business partner due diligence, we inform our business partners about these requirements before entering a business relationship. The Codes of Conduct of the Fresenius Group are publicly accessible, for more information see chapter Supply Chain.

Business partner and investment due diligence

All business segments and Fresenius SE & Co. KGaA conduct risk-based due diligence on business partners before entering into a business relationship. In each business segment, the business partners to be screened are selected on a risk-based basis according to defined criteria. A risk profile of the partner is drawn up and targeted measures are initiated: accordingly, the compliance contract clauses are based on the partner's risk profile to prevent corrupt actions. We also reserve the right to terminate the contract in the event of misconduct. If we suspect misconduct on the part of a business partner, we take additional measures which, depending on the severity of the misconduct, may include audits or certifications.

Whenever we decide on potential acquisitions and investments, we take compliance risks into account in due diligence measures, among other things via the Acquisition and Investment Council (AIC), which reviews planned acquisitions and investments in a defined process for Fresenius Kabi, Fresenius Helios, Fresenius Vamed and Fresenius SE & Co. KGaA. Every acquisition and investment proposal submitted to the Management Board must first be discussed, reviewed, and evaluated by the AIC. The AIC is made up of managers from various functions, including Compliance. If necessary, we initiate safeguarding measures and include, for example, compliance declarations and guarantees in the contracts. Following an acquisition, we integrate the new company into our compliance management systems as quickly as possible.

Financial transactions

We have implemented dedicated controls for cash transactions and banking transactions, such as the dual-control principle. We also monitor cash transactions that exceed a certain threshold. In this way, we want to ensure that all financial transactions are correctly accounted for, authorized, and processed. Thanks to automated processes, we can identify compliance risks at an early stage. Evaluations of compliance with threshold values as well as other verification processes for supplier master data in affected business segments also provide valuable guidance.

This year, the reinforcement and refinement of the Group-wide guidelines on cash and banking transactions was a major project across all business segments. In addition to further controls for payments, the new regulations mainly relate to controls to prevent money laundering. These Group-wide guidelines also provide guiding principles for the subsidiary policies.

Money laundering

Based on the risk profiles of our business segments, we have established measures to address money-laundering risks in the Fresenius Group as part of the implementation of the requirements of the Money Laundering Act for traders in goods. These measures include anti-money-laundering guidelines, specific topic-related risk analyses, internal controls such as the prohibition of certain cash payments, and auditing processes for relevant transactions. We have anchored the implemented controls in our guidelines and conduct training on them.

Trade restrictions

To provide people worldwide with access to lifesaving medicine and medical equipment we also supply products to countries that are subject to trade restrictions. Sanction mechanisms typically exempt or allow to apply for a licence for deliveries for humanitarian purposes or treatment of patients in medical need. It is particularly important to us to comply with all currently applicable legal provisions, e. g., with regard to sanctions or export controls. To this end, we have introduced various measures in the business segments concerned, such as monitoring processes and special IT system checks for deliveries that are subject to import or export restrictions. The measures depend on the specific risk in the country concerned. We aim to ensure that we can comply with all applicable sanctions and requirements for export controls, even in the event of short-term changes in legislation, such as currently experienced.

Reporting channels

If Fresenius employees suspect misconduct, e. g., violations of laws, regulations or internal guidelines, they can contact their supervisors or the responsible compliance officers and report the possible compliance incident. They can also report potential compliance incidents anonymously, e. g., by telephone or online via whistleblower systems and e-mail addresses set up specifically for this purpose. All business segments have established appropriate mechanisms. The whistleblower systems of Fresenius SE & Co. KGaA, Fresenius Medical Care, Fresenius Kabi and Fresenius Vamed are available via the corporate websites not only to employees, but also to third parties, e.g., customers, suppliers, and other partners, in a total of more than 30 languages

Tax compliance

GRI 205/103-2, GRI 207/103-1, 103-2, GRI 207-1, GRI 207-2, GRI 207-4

As a global health care group, we implement projects in over 100 countries and provide services to hospitals and health care facilities. Due to our business activities, we are subject to various local tax obligations.

In the countries in which we operate, we not only support the development of health care systems, but also create jobs that contribute to local tax revenue. This enables us to make a significant contribution to preserving the macroeconomic stability of national economies. At the same time, we want our business activities and the contributions we make to be accompanied by compensation for the demands on resources, infrastructure, services, labor and administration.

The basis for paying taxes is the business activities of Fresenius SE & Co. KGaA or one of our subsidiaries in a country. When choosing a location, other aspects such as the availability of qualified personnel, or political, economic, legal and regulatory framework conditions play a role in addition to strategic business issues. In the course of an overall assessment, the possibility of minimizing currency risks as well as tax considerations can also influence the choice of location.

Adhering to laws is the central principle of our understanding of compliance. This also includes compliance with all globally applicable tax obligations. This applies firstly to the Group’s income taxes, which must be regularly explained as part of IFRS financial reporting, and secondly to sales and wage taxes, which we pay in the various countries. Our goal is to fulfill all tax obligations seamlessly and punctually, and to always work within the legal framework. We refrain from implementing tax structures without business purpose or commercial reason.

The chief responsibility for the tax affairs of the Fresenius Group lies with the Management Board of Fresenius Management SE (FMSE). The functional responsibility for tax affairs is delegated by the Chief Financial Officer (CFO) to the management of the corporate tax department of Fresenius SE & Co. KGaA. As a result of Fresenius Medical Care’s listing on the stock exchange, the business segment has its own governance structure, also with regard to tax compliance.

The corporate tax department is generally responsible for the tax affairs of Fresenius SE & Co. KGaA. In addition, it provides various services for the individual subgroups and advises decision-makers in the departments at Group and subsidiary level on the fulfillment of their tax obligations. The department also actively proposes ways in which corporate structures and business transactions and processes can be implemented. This approach is intended to minimize risks and promote corporate objectives through forward-looking tax planning.

At the level of the business segments and their subsidiaries, the respective segments or local Chief Financial Officers (CFO) are generally responsible for tax affairs. These are supported either by the local tax departments, external advisers or the corporate tax department.

Employees in the respective roles are informed that compliance with and correct handling of the applicable rules are of central importance for the Fresenius Group. Information on ways to report suspected acts of non-compliance can be found on page 185 of the Fresenius separate Group Non-financial Report 2021.

Fresenius does not specifically settle in certain countries in order merely to generate tax benefits or create tax structures — the focus is always on the business activities of our companies. A few subsidiaries are located in countries known as tax havens. The Fresenius Group took over the majority of these companies as a result of acquisitions. The maintenance of these structures is always examined and evaluated in detail in the course of acquisitions.

The Fresenius Group maintains a cooperative, honest and respectful relationship with the tax authorities and other public institutions. To achieve this, regional and cultural differences in the respective countries are always taken into account.

The Fresenius Group has internal control systems in place in order to meet its tax compliance objectives. Globally, these are subject to the requirements of our Group-wide Fresenius Code of Conduct. Based on this, the respective organizations have their own standards. In this way, we ensure that the Fresenius Group complies with the tax and reporting requirements in all legal systems in which it operates. At the same time, the tax processes are also subject to review by external auditors.

As a global health care group, Fresenius is subject to numerous tax laws and regulations. In all four business segments and at the level of Fresenius SE & Co. KGaA, we have implemented risk-management systems that also cover tax risks. Risks arising from this are constantly identified, systematically recorded and assessed, taking into account the probability of occurrence and the possible financial risk. The risks identified through this process are reported in the external financial reporting. Emphasis is placed on preventing any acts of non-compliance regarding taxes before they occur.

The Management Board of FMSE is responsible for the Group's risk management system. Further details on the risk management system can be found in the Annual Report 2021.

| Effective Tax Rate | 2021 | 2020 | 2019 |

|---|---|---|---|

| Europe | 24.2% | 25.5% | 23.9% |

| North America | 21.1% | 22.2% | 20.1% |

| Asia-Pacific | 23.4% | 18.2% | 23.6% |

| Latin America | 26.4% | -27.5% | 57.1% |

| Africa | 28.0% | -193.8% | 63.6% |

| Group | 22.8% | 24.2% | 22.6% |

Transparency in the health care sector

GRI 102-13, -43, GRI 418/103-1

In the health care sector, transparency is of major importance with regard to business conduct, patient information and quality of care. More information can be found the chapter Patient and product safety.

Fresenius Group companies have to adhere to laws and our ethical principles that

- require us to track and report publicly payments made to health care professionals and organizations;

- require us to issue written notification or approval and to disclose the purpose and scope of the interaction between a Fresenius Group entity and health care professionals, such as in health care facilities;

- require us to publicly disclose data pursued in clinical trials as well as disclose to patients the information gathered in patient studies. This is linked to the public right to transparency regarding data used to approve new medicines, as well as provisions to adhere to relevant data protection standards; for more information see chapter Data Protection

- require transparency in pricing and reimbursement procedures for pharmaceutical products.

We are committed to respecting the codes and principles associated with membership of various associations. In addition, we disclose all donations to health care professionals in our business segments, in accordance with the publication requirements applicable to us.

Our goals

Our goal is to integrate our comprehensive understanding of compliance into our daily business. The aim is to prevent violations, continuously improve our compliance management systems, and to further evolve a "living compliance culture" Group-wide. Exchange on best practices from our business segments plays a key role here. Each year, all business segments develop operational goals and measures to further strengthen their compliance management systems. These are coordinated by the compliance responsibles and presented to the Compliance Steering Committee.

Progress and measures 2021

Risk assessment

In 2020, the business segments expanded the risk assessment to include bottom-up information, which they continued to carry out in 2021. Fresenius Kabi already introduced this approach in 2019 and continued this in the 2021 reporting year. Fresenius Helios, on the other hand, will implement bottom-up risk assessments in 2022. After introducing a harmonized IT tool, we made further adjustments to regulatory requirements and adapted existing risk processes in 2021. This way, we ensure an improved Group-wide compliance risk reporting.

Compliance training

Compliance training is a high priority for Fresenius. All employees are offered training on compliance issues, covering basic topics such as our Code of Conduct and corporate guidelines, as well as specific topics such as anti-corruption, antitrust law, anti-money-laundering, data protection, and information security.

To convey the content in a targeted manner, we rely on individual concepts tailored to the respective department and employees. We use various formats such as in-house training, live webinars, on-demand video training, and traditional online training. Participation in essential basic training, such as on the Code of Conduct, is mandatory.

Employees are prompted and reminded to participate in mandatory training courses, for example with automatic registration, or manual registration by compliance departments, human resources, or managers. To promote a risk-conscious and value-oriented corporate culture, we train executives using a dialog-based approach.

Fresenius Kabi focused on the topic of antitrust and the development of an e-learning program to combat money laundering and terrorism financing. Furthermore, Fresenius Kabi introduced entertaining and easy-to-understand video training in series format on various compliance topics, in addition to the mandatory training courses.

In the reporting year, Helios Spain began preparing additional training courses for the risks identified in the compliance risk assessment, in addition to the existing training courses on the Code of Conduct.

Workshops on the prevention of corruption and on the U.S. Foreign Corrupt Practices Act (FCPA) were held at Fresenius Vamed.

Furthermore, in addition to the mandatory training courses, entertaining and easy-to-understand video training courses in series format on various compliance topics and the subject of information security, further information in the chapter Cybersecurity, were introduced in several areas of the Group.

Continuing development of the business partner due diligence

Fresenius Medical Care enhanced its global internal audit activities by improving the resources and focusing on anti-corruption in high-risk areas. More than 80% of internal audits included a compliance focus. Prior to entering new business relationships, and as part of its continuous monitoring of existing business relationships, the company assesses third parties for compliance risks. In 2021, the business segment assessed and approved 29,000 third parties. In addition, Fresenius Medical Care has implemented their third-party training approach at global level. In the scope of the business segment´s training third parties refer to those in the sales channel. These include distributors, re-sellers, wholesalers, commercial, or sales agents. They also refer to any other third party involved in the sales of the products that potentially interact with government officials or health care professionals for sales of the products. The business segment also continued to conduct anti-corruption-related audits of third-party business partners. Fresenius Medical Care undertook 17 audits, exceeding its target to complete 15 in the reporting year.

Fresenius Kabi improved its systems and processes in the area of business partner screening in 2021. For example, what is known as robot-assisted process automation (RPA) is now used to provide further background information on business partners. Since its launch in April 2021, the RPA solution has automatically provided the persons responsible for the due diligence with a report for each business partner due diligence carried out using our system. This report contains Internet search results against certain search terms and a current search report from our third-party provider for business partner data showing potential red flags. For medium- and higher-risk business partners, the RPA solution delivers the result of another dedicated sanctions list check. The associated guidelines and training courses are currently being revised. Fresenius Kabi has also updated its anti-money-laundering and counter-terrorist-financing policy to reflect the current legal situation and the first national risk analysis.

Helios Spain launched a more comprehensive project in the reporting year that will lead to business partner due diligence for every supplier or business partner in the division in the future. Further information can be found in the Supply chain chapter on page 199.

Fresenius Vamed has established a risk-based business partner due diligence as part of the continuing development of business partner audits. In addition, guidelines for the prevention of corruption have been introduced.

Dealing with conflicts of interest

GRI 102-25, GRI 406/103-3, GRI 406-1

At Fresenius SE & Co. KGaA, we support our employees in dealing responsibly with conflicts of interest. We provide relevant internal policies, and guidelines, as well as answers to the most frequent questions, on the intranet. Training and regular updates complement the activities at the Group level and within the business segments. Our Corporate Compliance department is also available as a contact partner for all questions.

Fresenius Kabi introduced a comprehensive, global anti-bribery and anti-corruption policy during 2021 that sets out clear rules and principles for avoiding bribery and corruption within the company and in connection with interactions with third parties. These guidelines replace older regulations, e. g., on dealing with healthcare professionals and organizations and on conflicts of interest, and bring these rules together in a uniform document.

Helios Germany updated its anti-corruption policy in 2021 and adapted it to current requirements. The focus here was on the experience gained during implementation, as well as adaptation to the current framework conditions. At Helios Spain, new anti-corruption guidelines were drawn up in the reporting year, covering topics such as participation in congresses, travel and representation expenses, and donations. Training on these guidelines is in preparation.

Evaluation

GRI 205/103-3, GRI 406/103-3, GRI 406-1, GRI 419/103-3

Audits and inspections

The Internal Audit departments conduct independent audits to improve the effectiveness of the risk management, control and governance processes at Fresenius SE & Co. KGaA and in the Group companies of the business segments. This was also done in 2021, taking into account risk-based measures of the compliance organizations such as policies and procedures as well as their implementation. If weaknesses are identified, Internal Audit monitors the implementation of remediation actions taken by the respective management. The audit engagement results are analyzed by the compliance organizations and are incorporated into the continuous improvement of existing measures.

At Helios Germany, adherence to the business segment's transparency regulations is monitored on a random basis in regular transparency reviews. With the Compliance Cockpit, Fresenius Kabi has a tool that provides managers of each subsidiary with an annual overview of compliance-relevant key parameters based on external and internal indicators. Fresenius Kabi reviews these key parameters annually and defines monitoring measures for those subsidiaries with an increased risk profile. Fresenius Kabi also conducts regular reviews of compliance initiatives in the form of workshops. Fresenius Kabi's compliance organization organized various international workshops again in 2021. The workshops not only served as intensive training for local employees, but also enabled compliance officers to review and, if necessary, improve their understanding of compliance, the effectiveness of local implementation of internal guidelines, and the development and improvement of central compliance initiatives.

Reports in 2021

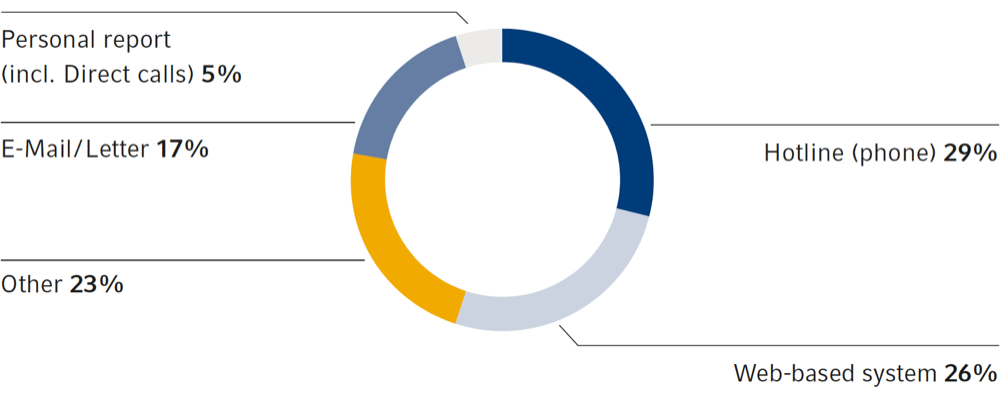

In 2021, a total of 2,119 compliance reports¹ were received via the reporting channels. They were collected via different input channels as shown in the graph.

The compliance reports were assigned to the following topic groups, among others: Business Integrity including Anti-Corruption (105 reports), Data Protection (659 reports), and Human Resources / Workplace (1,040 reports).

1 For Fresenius Medical Care in North America, the hotline system was used for multiple reporting purposes: In addition to the reporting of compliance concerns, reports can also be made on patient care and safety. These patient-related cases were not included in the Group-wide number of compliance reports.

Messages by input channel

Dealing with possible compliance violations

We take all potential compliance violations seriously. An initial assessment focuses on the plausibility and possible severity level of the potential violation. We take every case of possible misconduct as an opportunity to review our corporate processes for improvements. The severity of the compliance violation determines who is responsible for further investigation. If necessary, a dedicated team takes over the investigation, which may include internal professionals or external support. Measures are implemented in a timely manner by the responsible management in close cooperation with the responsible compliance officers. Depending on the type and severity of the misconduct, disciplinary sanctions or remedies under civil or criminal law may be imposed. After completion of the investigation, we implement measures to prevent similar misconduct in the future. Further information pursuant to § 289c (3) No. 6 HGB on the Non-Prosecution Agreement of Fresenius Medical Care can be found in the Notes to the Consolidated Financial Statements.