Fresenius is a global healthcare Group in the legal form of an SE & Co. KGaA (a partnership limited by shares). As a therapy-focused healthcare company, Fresenius offers system-critical products and services for leading therapies for the treatment of critically and chronically ill patients.

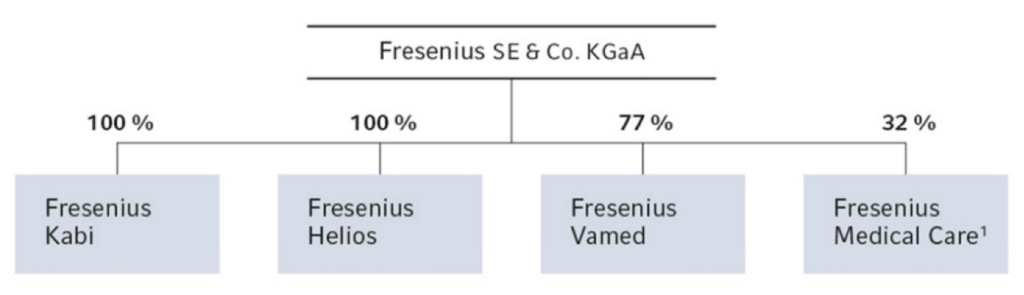

In addition to the activities of the parent company Fresenius SE & Co. KGaA, Bad Homburg v. d. H., Germany, the operating activities in the 2023 fiscal year were spread across the following legally incorporated, fully consolidated business segments:

- Fresenius Kabi

- Fresenius Helios

- Fresenius Vamed

- Fresenius Medical Care1

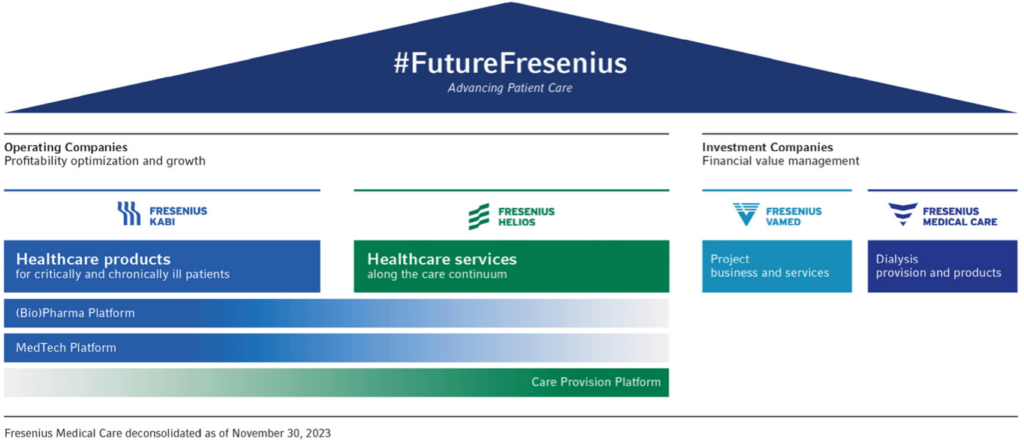

As part of the strategic review of the Fresenius Group, since the 2023 fiscal year, we have distinguished between the Operating Companies Fresenius Kabi and Fresenius Helios (each with 100% ownership share) and the Investment Companies Fresenius Medical Care (32% ownership share) and Fresenius Vamed (77% ownership share).

1 Deconsolidated as of November 2023

group structure

For the Operating Companies, the focus is on profitability optimization and growth. For the Investment Companies, the focus is on financial value management.

Fresenius SE & Co. KGaA is the largest shareholder of Fresenius Medical Care AG with a 32% stake. By changing the legal form of Fresenius Medical Care AG & Co. KGaA into a stock corporation, Fresenius Medical Care was deconsolidated in the reporting year. Since November 30, 2023, the investment in Fresenius Medical Care has been accounted for using the equity method in accordance with IAS 28.

Operating Companies

- Fresenius Kabi specializes in products for the therapy and care of critically and chronically ill patients. The portfolio includes biopharmaceuticals, clinical nutrition, MedTech products, intravenously administered generic drugs (generic IV drugs), and IV fluids.

- Fresenius Helios is Europe's leading private healthcare service provider. In fiscal year 2023, the company included Helios Germany, Helios Spain, and Eugin Group, which was sold on January 31, 2024. Helios Germany operates 86 hospitals, ~230 medical care centers, 27 occupational health centers, and 6 prevention centers. Helios Spain operates 51 hospitals, ~100 outpatient health centers and around 300 facilities for occupational health management. Helios Spain is also active in Latin America with 8 hospitals and as a provider of medical diagnostics.

Investment Companies

- Fresenius Vamed manages projects and provides services for hospitals and other healthcare facilities on an international level. The range of services covers the entire value chain: from development, planning, and turnkey construction to maintenance, technical management, total operational management, and high-end services. The company comprises three functional areas: High-End Services (HES), Health Facility Operations (HFO) and Health Tech Engineers (HTE) and is steered according to the Projects and Services reporting segments.

- Fresenius Medical Care offers services and products for patients with chronic kidney failure. Dialyzers and dialysisDialysisForm of renal replacement therapy where a semipermeable membrane – in peritoneal dialysis the peritoneum of the patient, in hemodialysis the membrane of the dialyzer – is used to clean a patient’s blood. machines are among the most important product lines. In addition, Fresenius Medical Care offers dialysis-related services.

group-wide operating model

Operating model and functional services

Within the Fresenius Group, we provide effective, supportive service and governance functions as part of the operating model initiated in the 2023 fiscal year, which benefit our business segments and increase the Group's overall capital efficiency. This framework enables us to steer and improve performance in a more targeted manner in the future based on the Fresenius Financial Framework.

Important markets and competitive position

Fresenius operates in more than 60 countries through its subsidiaries. The main markets are Europe with 73% and North America with 12% of revenue, respectively. Fresenius operates an international distribution network and more than 50 production sites.

Fresenius Kabi aims to make a significant contribution to the treatment and care of critically and chronically ill patients with its products and services. In this area of care particularly, the need for high-quality, modern, and affordable therapies is growing, as the proportion of chronic diseases is steadily increasing.

Fresenius Kabi is one of the leading companies in Europe for large parts of its product portfolio and has significant market shares in the growth markets of Asia-Pacific and Latin America. Furthermore, Fresenius Kabi is one of the leading companies in the field of generic IV drugs both in the U.S. market and in Europe.

Fresenius Helios is Europe's leading private healthcare service provider. Helios Germany and Helios Spain are the largest private hospital operators in their respective home markets.

Fresenius Vamed is a global company with no direct competitors covering a comparably comprehensive portfolio of projects, services, and total operational management over the entire life cycle of healthcare facilities. As a result, Fresenius Vamed has a unique selling proposition of its own. Depending on the business segment, the company competes with international companies and consortia, as well as with local providers.

The company is one of the leading private operators of rehabilitation and care facilities in Central Europe.

External factors

In fiscal year 2023, the difficult macroeconomic environment had a negative impact on business development. This included increased uncertainties, inflation-related cost increases, staff shortages, and increased energy costs.

Despite the challenging market environment, the structural growth drivers in the non-cyclical healthcare markets are in place.

The legal framework for the operating business of the Fresenius Group remained essentially unchanged in 2023.

Fluctuating exchange rates, particularly between the U.S. dollar and the euro, have an effect on the income statement and the balance sheet. In 2023, the average annual exchange rate between the U.S. dollar and the euro of 1.08 was above the 2022 rate of 1.05. This resulted in a negative currency translation effect on the income statement in fiscal year 2023. Details of this can be found in the statement of comprehensive income. The extraordinarily high inflation in Argentina and the associated devaluation of the Argentinian peso had a negative impact on the consolidated income statement.

In the reporting year, the Fresenius Group was involved in various legal disputes resulting from business operations. Although it is not possible to predict the outcome of these disputes, none is expected to have a significant adverse impact on the assets and liabilities, financial position, and results of operations of the Group.

We carefully monitor and evaluate country-specific, political, legal, and financial conditions regarding their impact on our business activities. This also applies to the potential impact of inflation and currency risks.

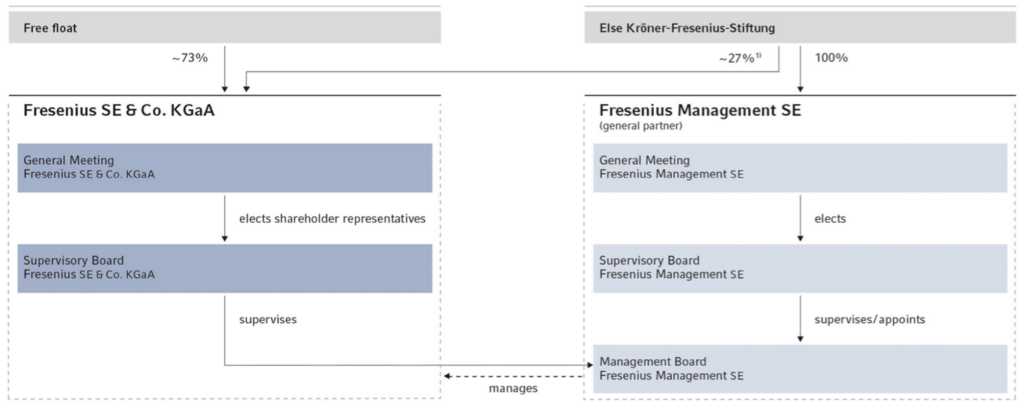

Management and control

In the legal form of a KGaA, the Company's corporate bodies are the Annual General Meeting, the Supervisory Board, and the general partner, Fresenius Management SE. Fresenius Management SE is wholly owned by Else Kröner-Fresenius-Stiftung. The KGaA has a two-tier management system management and control are strictly separated.

corporate structure at fresenius SE & Co. KGaA

1 For selected items no voting power, e.g., election of Supervisory Board of Fresenius SE & Co. KGaA, discharge of general partner and Supervisory Board of Fresenius SE & Co. KGaA, election of the auditor.

The general partner, represented by its Management Board, conducts the business, and represents the Company in dealings with third parties. Since the deconsolidation of Fresenius Medical Care took effect on November 30, 2023, the Management Board has consisted of five members. According to the Management Boards rules of procedure, each member is accountable for his or her own area of responsibility. However, the members have joint responsibility for the management of the Group. In addition to the Supervisory Board of Fresenius SE & Co. KGaA, Fresenius Management SE has its own Supervisory Board. The Management Board is required to report to the Supervisory Board of Fresenius Management SE regularly, in particular on its corporate policy and strategies. In addition, the Management Board reports on business profitability, current operations, and any other matters that could be of significance for the Company's profitability and liquidity. The Supervisory Board of Fresenius Management SE also advises and supervises the Management Board in its management of the Company. It is prohibited from managing the Company directly. However, the Management Boards rules of procedure require that certain transactions obtain the prior approval of the Supervisory Board of Fresenius Management SE.

The members of the Management Board are appointed and dismissed by the Supervisory Board of Fresenius Management SE. Appointment and dismissal is in accordance with Article 39 of the SE Regulation1. The articles of association of Fresenius Management SE also provide that deputy members of the Management Board may be appointed.

1 Council Regulation (EC) No. 2157 / 2001 of October 8, 2001 on the Statute for a European Company (SE) (SE Regulation - SE-Reg)

The Supervisory Board of Fresenius SE & Co. KGaA advises on and supervises the management of the Company's business by the general partner, reviews and approves the annual financial statements and the consolidated financial statements, and performs the other functions assigned to it by law and the Company's articles of association. It is involved in corporate planning and strategy, and in all matters of fundamental importance for the Group. The Supervisory Board of Fresenius SE & Co. KGaA has six shareholder representatives and six employee representatives. A Nomination Committee of the Supervisory Board of Fresenius SE & Co. KGaA has been instituted for election proposals for the shareholder representatives. Its activities are aligned with the provisions of law and the Corporate Governance Code. The shareholder representatives are elected by the Annual General Meeting of Fresenius SE & Co. KGaA. The European works council elects the employee representatives to the Supervisory Board of Fresenius SE & Co. KGaA.

The Supervisory Board must meet at least twice per calendar half-year. The Supervisory Board of Fresenius SE & Co. KGaA has two permanent committees: the Audit Committee, consisting of five members, and the Nomination Committee, consisting of three members. The Company's annual corporate governance declaration pursuant to Section 315d and Section 289f of the German Commercial Code (HGB) describes the procedures of the Supervisory Board's committees. The declaration can also be found on the website www.fresenius.com / corporate-governance.

The descriptions of both the compensation system and individual amounts paid to the Management Board and Supervisory Board of Fresenius Management SE, and the Supervisory Board of Fresenius SE & Co. KGaA, are included in the Compensation Report.

Capital, shareholders, articles of association

The subscribed capital of Fresenius SE & Co. KGaA amounted to 563,237,277 ordinary shares as of December 31, 2023 (December 31, 2022: 563,237,277).

The shares of Fresenius SE & Co. KGaA are non-par-value bearer shares. Each share represents €1.00 of the capital stock. Shareholders rights are regulated by the German Stock Corporation Act (AktG Aktiengesetz) and the articles of association.

Fresenius Management SE, as general partner, is authorized, subject to the consent of the Supervisory Board of Fresenius SE & Co. KGaA: to increase the subscribed capital of Fresenius SE & Co. KGaA by a total amount of up to €125 million, until May 12, 2027, through a single issuance or multiple issuances of new bearer ordinary shares against cash contributions and / or contributions in kind (Authorized Capital I).

In principle, the shareholders shall be granted a subscription right. In certain cases, however, the right of subscription can be excluded.

In addition, there are the following Conditional Capitals according to the articles of association of June 15, 2023:

- The subscribed capital is conditionally increased by up to €4,735,083.00 through the issuance of new bearer ordinary shares (Conditional Capital I). The conditional capital increase will only be executed to the extent that convertible bonds for ordinary shares have been issued under the 2003 Stock Option Plan and the holders of these convertible bonds exercise their conversion rights. Following the expiry of the 2003 Stock Option Plan in 2018, Conditional Capital I is no longer used.

- The subscribed capital is conditionally increased by up to €3,452,937.00 through the issuance of new bearer ordinary shares (Conditional Capital II). The conditional capital increase will only be executed to the extent that subscription rights have been issued under the 2008 Stock Option Plan, the holders of these subscription rights exercise their rights, and the Company does not use its own shares to service the subscription rights or does not exercise its right to make payment in cash. Following the expiry of the 2008 Stock Option Plan in 2020, Conditional Capital II is no longer used.

- The general partner is authorized, with the approval of the Supervisory Board, until May 12, 2027, to issue option bearer bonds and / or convertible bearer bonds, once or several times. To fulfill the granted subscription rights, the subscribed capital of Fresenius SE & Co. KGaA was increased conditionally by up to €48,971,202.00 through issuance of new bearer ordinary shares (Conditional Capital III).

The conditional capital increase shall only be implemented to the extent that the holders of convertible bonds issued for cash, or of warrants from option bonds issued for cash, exercise their conversion or option rights and as long as no other forms of settlement are used. As of December 31, 2023, Fresenius had not utilized this authorization. - The share capital is conditionally increased by up to €22,824,857.00 by the issuance of new ordinary bearer shares (Conditional Capital IV). The conditional capital increase will only be implemented to the extent that subscription rights have been, or will be, issued in accordance with the Stock Option Program 2013 and the holders of subscription rights exercise their rights, and the Company does not grant its own shares to satisfy the subscription rights. As of December 31, 2023, Fresenius had not utilized this authorization.

The Company is authorized, until May 12, 2027, to purchase and use its own shares up to a maximum amount of 10% of the subscribed capital. In addition, when purchasing its own shares, the Company is authorized to use equity derivatives with possible exclusion of any tender right. The Company had not utilized this authorization as of December 31, 2023.

As the largest shareholder, Else Kröner-Fresenius-Stiftung, Bad Homburg, Germany, informed the Company on December 1, 2023, that it held 151,842,509 ordinary shares of Fresenius SE & Co. KGaA. This corresponds to an equity interest of 27.0% as of December 31, 2023.

Amendments to the articles of association are made in accordance with Section 278 (3) and Section 179 (2) of the German Stock Corporation Act (AktG) in conjunction with Article 17 (3) of the articles of association of Fresenius SE & Co. KGaA. Unless mandatory legal provisions require otherwise, amendments to the articles of association require a simple majority of the subscribed capital represented in the resolution. If the voting results in a tie, a motion is deemed rejected. Furthermore, in accordance with Section 285 (2) sentence 1 of the German Stock Corporation Act (AktG), amendments to the articles of association require the consent of the general partner, Fresenius Management SE. The Supervisory Board is entitled to make such amendments to the articles of association that only concern their wording without a resolution of the Annual General Meeting.

Under certain circumstances, a change of control would impact our major long-term financing agreements, which contain customary change of control provisions that grant creditors the right to request early repayments of outstanding amounts in case of a change of control. The majority of our financing arrangements, in particular our bonds placed in the capital markets, however, require that the change of control is followed by a decline or a withdrawal of the Company's rating or that of the respective financing instruments.

Contact

Fresenius SE & Co. KGaA

Investor Relations

+49 (0) 6172 608-2485

ir-fre@fresenius.com