In a stabilizing macroeconomic environment and supported by strong business results, the Fresenius share performed positively overall over the course of the fiscal year and achieved a total return of around +11%.

Stock markets and development of the Fresenius share

The fears of recession that were still prevalent at the start of 2023 did not materialize overall over the course of the fiscal year. Supported by emerging markets such as China and, among the industrialized countries, the United States in particular, the global economy showed stable development overall with moderate growth. In view of the decline in global inflation, which continued over the course of the year, central banks announced interest rate cuts towards the end of 2023.

In the wake of these developments, the global stock markets recorded significant gains over the course of the year. In the United States, the growth in the leading S & P 500 and Dow Jones Industrial Average indices was primarily driven by companies from the technology and artificial intelligence sectors. In Europe, the STOXX® Europe 500 gained around 13% in the 2023 fiscal year; the most important German stock market barometer, the DAX40, even rose by around 19%. The STOXX® Europe 600 Health Care, which tracks the comparatively defensive European healthcare sector, gained around 6% over the course of the year.

The closing price of the Fresenius share on December 29, 2023, the last trading day of the year, was € 28.07, around 7% higher than the closing price at the end of 2022. The Fresenius share reached its low for the year of € 23.46 on March 15, 2023, and its high for the year at € 31.11 on September 20, 2023. Including the dividend paid, Fresenius shareholders saw a total return of around 11% in 2023.

At www.fresenius.com/shareprice-center you can find an interactive chart tool for graphical display and further analysis of the share price development. You can also find out how the Fresenius share has performed compared to the shares of competitors.

The market capitalization of Fresenius was € 15.8 billion as of December 31, 2023. The average daily trading volume on Xetra amounted to 1,286,530 shares in the 2023 fiscal year.

Capitalization

The total number of issued shares at the end of 2023 was 563,237,277 and thus remained unchanged during the 2023 fiscal year. Information on stock option plans can be found in the Notes.

Key data of the Fresenius share

Download(XLS, 38 KB)| 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|

| Number of shares | 563,237,277 | 563,237,277 | 558,502,143 | 557,540,909 | 557,379,979 |

| Stock exchange quotation1 in € | |||||

| High | 31.11 | 37.88 | 47.44 | 50.32 | 52.42 |

| Low | 23.46 | 20.04 | 33.35 | 25.66 | 40.74 |

| Year-end quotation | 28.07 | 26.25 | 35.40 | 37.84 | 50.18 |

| Market capitalization2 in million € | 15,810 | 14,785 | 19,771 | 21,097 | 27,969 |

| Total dividend distribution in million € | – | 518 | 514 | 491 | 468 |

| Dividend per share in € | – | 0.92 | 0.92 | 0.88 | 0.84 |

| Earnings per share in €3 | 2.67 | 3.08 | 3.35 | 3.22 | 3.37 |

| 1 Xetra closing price on the Frankfurt Stock Exchange | |||||

| 2 Total number of ordinary shares multiplied by the respective Xetra year-end quotation on the Frankfurt Stock Exchange | |||||

| 3 Net income attributable to shareholders of Fresenius SE & Co. KGaA; before special items | |||||

Investor relations

Our investor relations activities are in accordance with the transparency rules of the German Corporate Governance Code. We communicate comprehensively, promptly, and openly with private and institutional investors, as well as financial analysts. The equal treatment of all market actors is very important to us. In addition to our current financial results and guidance, the focus is also on the strategy and long-term positioning of the Fresenius Group.

We maintained an intense dialog with the capital markets in 2023 both virtually and in person. We were in direct contact with institutional investors and analysts on 14 days at international investor conferences, 22 roadshow days and in numerous one-on-one meetings. We also organized CEO calls and virtual field trips with banks, giving investors and analysts the opportunity to discuss matters with the Management Board. In 2023, we once again held our annual corporate governance roadshow together with the Supervisory Board.

Communication with private investors was maintained both virtually and in person at events organized by shareholder associations.

In addition, interested parties had access to live webcasts of the conference calls on our quarterly results at https://www.fresenius.com/events-and-roadshows as well as the constantly expanding range of information on our social media channels on LinkedIn or "X" (Twitter).

Fresenius’ Investor Relations team was recognized in this year’s Investors’ Darling competition by manager mag-azin with third place in the overall ranking and received the special award in the Investor Relations category.

In addition, Fresenius’ capital market communication achieved third place in the IR-Benchmark ranking of the NetFed agency.

For additional information on the Fresenius Group and share, please visit us at www.fresenius.com/investors.

Dividend

Due to legal restrictions resulting from the utilization of state compensation and reimbursement payments for increased energy costs provided for in the Hospital Financing Act ("Krankenhausfinanzierungsgesetz"), it will not be proposed to the 2024 Annual General Meeting to distribute a dividend for the 2023 fiscal year.

Irrespective of the legally required suspension of dividend payments for the 2023 fiscal year, Fresenius will maintain its dividend policy for the future. In the future, we continue to aim to increase the dividend in line with earnings per share growth (before special itemsBefore special itemsIn order to measure the operating performance extending over several periods, key performance measures are adjusted by special items, where applicable. Adjusted measures are labelled with “before special items”. A reconciliation table is available within the respective quarterly or annual report and presents the composition of special items., in constant currency) but at least maintain the dividend at the prior-year’s level.

Shareholder structure

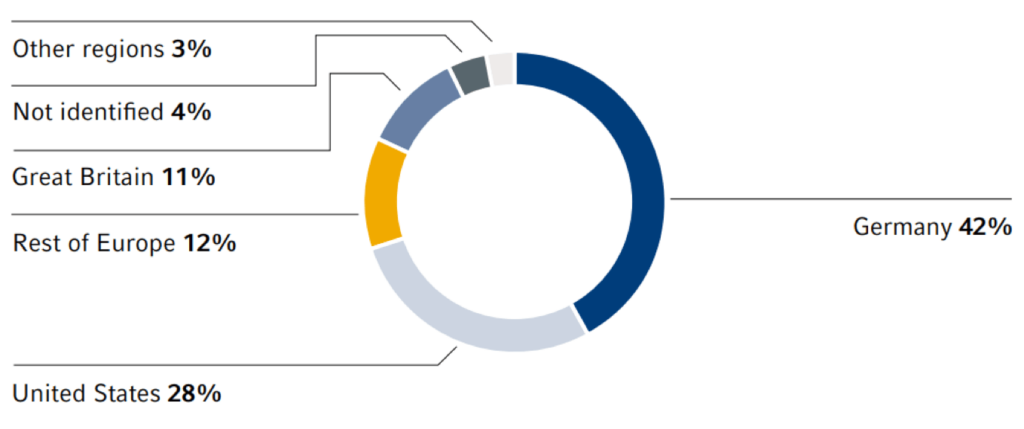

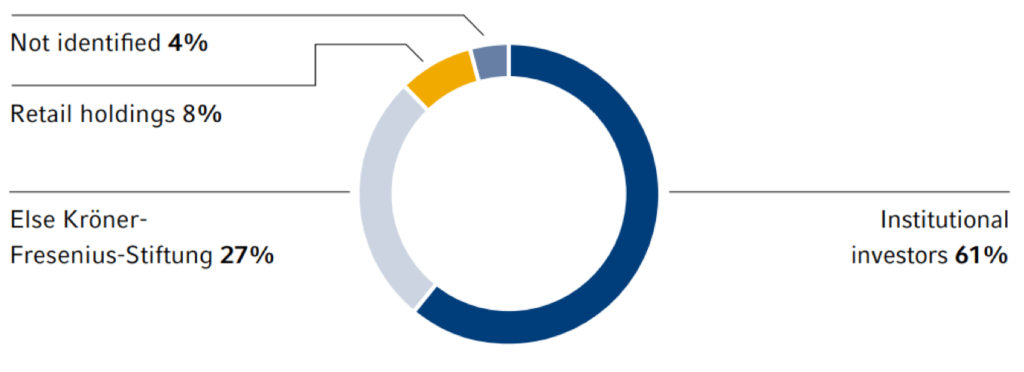

The charts on the right show the shareholder structure at the end of 2023.

The Else Kröner-Fresenius-Stiftung was the largest shareholder of Fresenius SE & Co. KGaA, with 27% of the shares.

According to notifications pursuant to the German Securities Trading Act (WpHG), there was no investor in the Fresenius shareholder base apart from the Else Kröner-Fresenius-Stiftung with voting rights of more than 5%. Voting rights notifications can be found at www.fresenius.com/shareholder-structure.

As of December 31, 2023, a shareholder survey identified the ownership of about 96% of our subscribed capital. According to this analysis, Fresenius can rely on a solid shareholder base: as in the previous year, over 600 institutional investors in total held about 61% of shares outstanding. The 10 largest institutional investors held about 20% (2022: 23%) of the share capital. 8% of Fresenius shares were again identified as retail holdings.

Our shares were mostly held by investors in Germany, the United States, and the United Kingdom.

Shareholder structure by region

Shareholder structure by investors

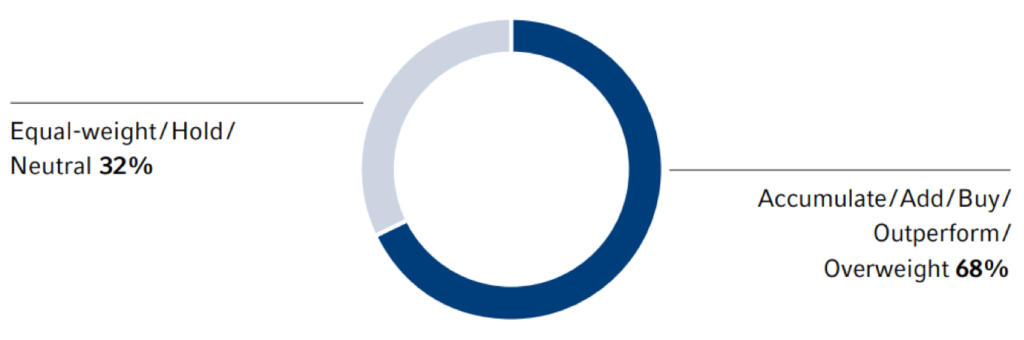

Analyst recommendations

The recommendations published by financial analysts are an important guide for institutional and private investors when making investment decisions. According to our survey, as of February 12, 2024, we were rated with 13 “buy”, 6 “hold” recommendations and no sell recommendations.

At www.fresenius.com/analysts-and-consensus you can find out which banks regularly report on Fresenius and rate our shares.

Analyst recommendations

ADR program

In the United States, Fresenius has a Sponsored Level I American Depositary Receipt (ADR) program. In this pro-gram, four Fresenius ADRs correspond to one Fresenius share. They are priced in U.S. dollars and traded in the U.S. over-the-counter (OTC) market.

You can find further information on our ADR program on www.fresenius.com/adr.

Contact

Fresenius SE & Co. KGaA

Investor Relations

+49 (0) 6172 608-2485

ir-fre@fresenius.com