The Fresenius share price continued to be impacted by the challenging macroeconomic environment during fiscal year 2022. Despite these challenges, we propose to keep the dividend at the same level as the previous year.

Stock markets and development of the fresenius share

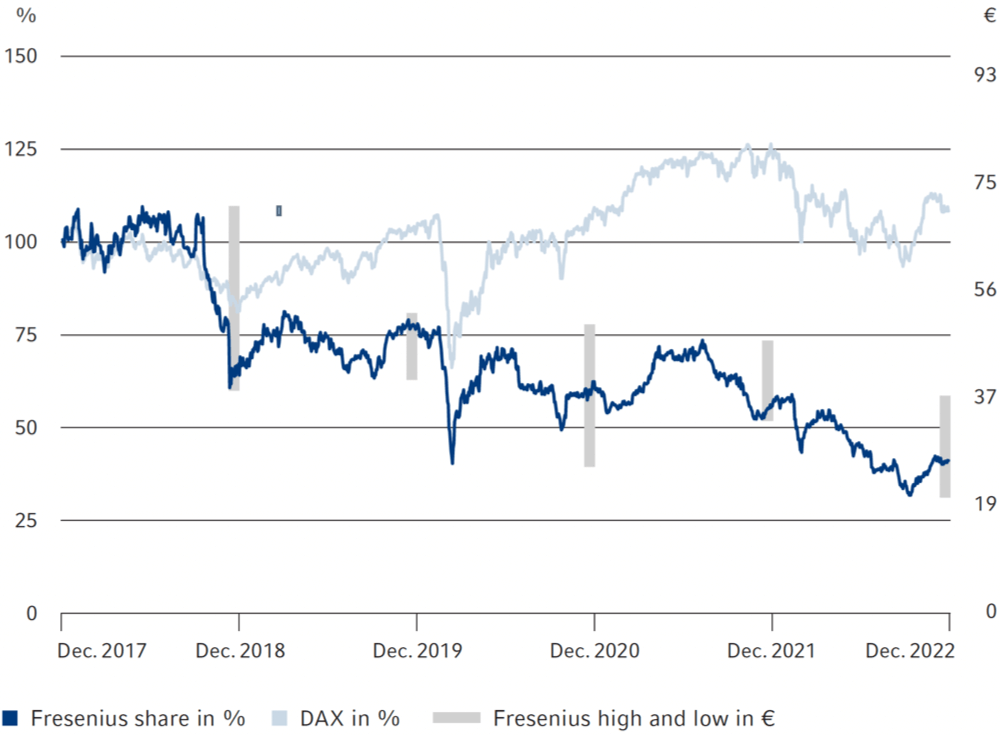

The ongoing war in Ukraine negatively impacted inflationary pressures on the global economy in 2022. The Fresenius share price declined significantly in the first half of the year, from which it gradually recovered in the course of the last quarter. This was due to the difficult macroeconomic environment characterized by inflation-related cost increases, staff shortages, supply chain disruptions, and the ongoing impact of the COVID-19 pandemic. This had a direct impact on customer and patient behavior.

The inflationary environment prompted global central banks to implement massive key interest rate hikes. These, as well as resulting recession concerns, put strong pressure on international capital markets in 2022.

The DAX, Germany’s most important stock market barometer, fell 12% during 2022. The Dow Jones STOXX© Europe 600 ended the year with a decrease of 13%, the largest decline during a single year since fiscal year 2008. In this index, the healthcare sector (Dow Jones STOXX© Europe 600 Health Care) fell by 8%. The leading U.S. indices performed as follows: the S & P 500 and the Dow Jones Industrial Average both fell, by 18% and 9%, respectively.

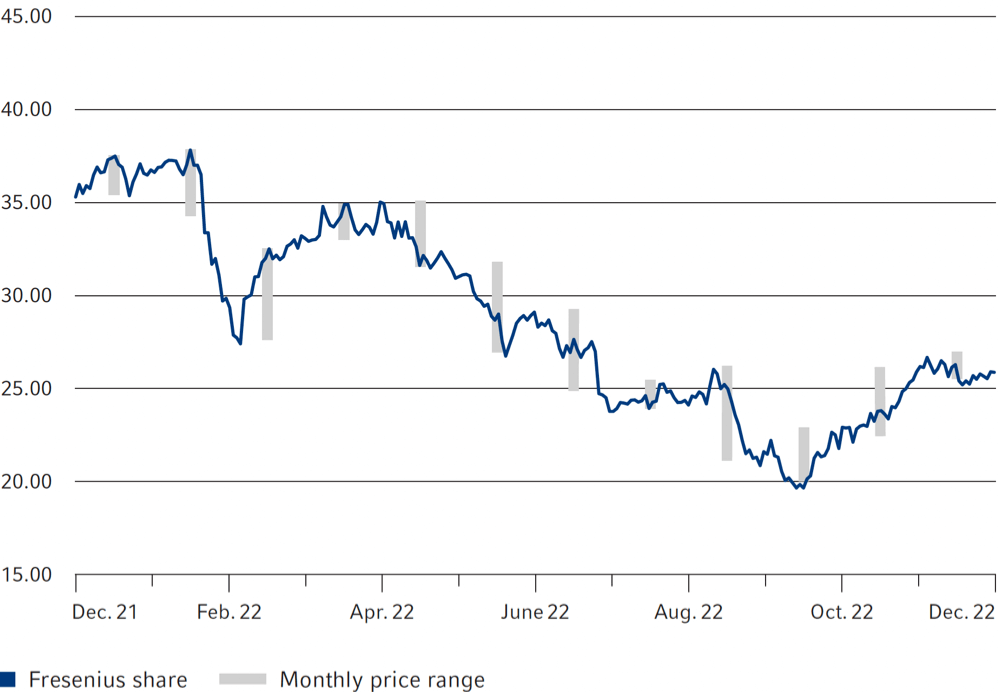

The closing price for the Fresenius share on December 30, 2022, was € 26.25 and thus 26% below the closing price of 2021. During the course of the year, the lowest price was recorded on October 14 at € 20.04, and the highest on February 16 at € 37.88.

At https://www.fresenius.com/share-price-center you can find an interactive chart tool for graphical display and further analysis of the shares. You can also find out how the Fresenius share has performed compared to the shares of competitors.

The market capitalization of Fresenius was € 14.8 billion as of December 30, 2022. The average daily trading volume on Xetra increased by 13% to 1,590,013 Fresenius shares (2021: 1,405,536 shares). In the United States, Fresenius has a Sponsored Level I American Depositary Receipt (ADR) program. In this program, four Fresenius ADRs correspond to one Fresenius share.

Relative share price performance 2018 – 2022 Fresenius share vs. DAX

Absolute share price performance 2022 Fresenius share in €

Capital structure

The total number of issued shares at the end of the year was 563,237,277 (December 31, 2021: 558,502,143 shares). The increase is solely due to the issue of new shares as part of the optional dividend (stock dividend) for the 2021 fiscal year. Information on stock option plans can be found in the Notes.

Key data of the Fresenius share

Download(XLS, 39 KB)| 2022 | 2021 | 2020 | 2019 | 2018 | |

|---|---|---|---|---|---|

| Number of shares | 563,237,277 | 558,502,143 | 557,540,909 | 557,379,979 | 556,225,154 |

| Stock exchange quotation1 in € | |||||

| High | 37.88 | 47.44 | 50.32 | 52.42 | 70.94 |

| Low | 20.04 | 33.35 | 25.66 | 40.74 | 38.99 |

| Year-end quotation | 26.25 | 35.40 | 37.84 | 50.18 | 42.38 |

| Market capitalization2 in million € | 14,785 | 19,771 | 21,097 | 27,969 | 23,573 |

| Total dividend distribution in million € | 5183 | 513.8 | 490.6 | 468.0 | 445.0 |

| Dividend per share in € | 0.923 | 0.92 | 0.88 | 0.84 | 0.80 |

| Earnings per share in €4 | 3.08 | 3.35 | 3.22 | 3.37 | 3.37 |

| 1 Xetra closing price on the Frankfurt Stock Exchange | |||||

| 2 Total number of ordinary shares multiplied by the respective Xetra year-end quotation on the Frankfurt Stock Exchange | |||||

| 3 Proposal | |||||

| 4 Net income attributable to shareholders of Fresenius SE & Co. KGaA; before special items | |||||

Investor relations

Our investor relations activities are in accordance with the transparency rules of the German Corporate Governance Code. We communicate comprehensively, promptly, and openly with private and institutional investors, as well as financial analysts. The equal treatment of all market actors is very important to us.

We also maintained our intense dialog with the capital markets in 2022 both virtually and in person.

We continued our contacts with institutional investors and analysts and spent 18 days at international investor conferences, 10 days at roadshows, and held numerous one-on-one meetings. We also organized CEO calls and virtual field trips with banks, giving investors and analysts the opportunity to discuss matters with the Management Board.

We continued to communicate with private investors, in particular via the Internet. In addition, we participated in three virtual events and one on-site private shareholder event in 2022.

At https://www.fresenius.com/events-and-roadshows our private shareholders can follow live webcasts of the conference calls and can make use of the continuously increasing range of information offered on our website and social media channels on Twitter and LinkedIn.

In 2022, Fresenius’ IR team was recognized as the best IR team among the “Medical Technologies & Services” sector by the Europe-wide “Institutional Investor Survey”. In this survey, the IR program was awarded first place and the ESG program second place.

In this year’s “Investors’ Darling” initiative by Manager Magazin, the team was also awarded the “Best Investor Relations” prize and the “Best Digital Communications” prize. The benchmark analysis by NetFed also awarded the Fresenius IR team first place. In the DIR initiative – “Digital Investor Relations” – the Fresenius IR team twice achieved second place in the categories “Best in Digital Reporting” and “DAX 40”.

For additional information visit us at www.fresenius.com/investors.

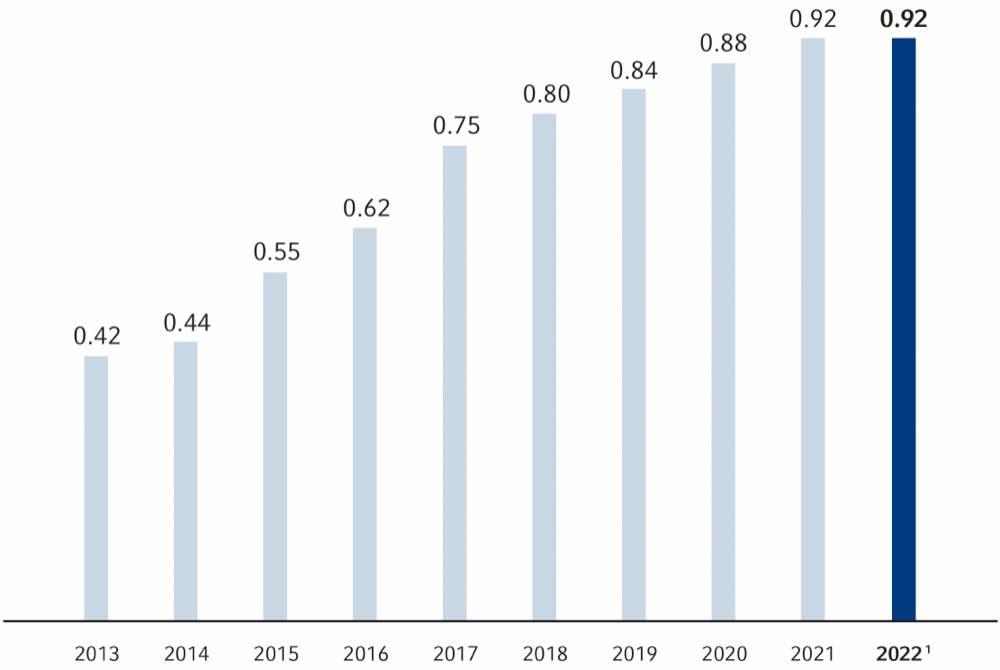

Dividend

Fresenius’ business was negatively impacted by the difficult macroeconomic environment in 2022. Despite these challenges, we propose to the Annual General Meeting to keep the dividend at the same level at € 0.92 per share (2021: € 0.92). The proposed dividend distribution to the shareholders of Fresenius SE & Co. KGaA would be €518 million or 30% of Group net income. Based on the proposed dividend and the closing price at the end of 2022, the dividend yield is 3.5%.

Development of dividends in €

Shareholder structure

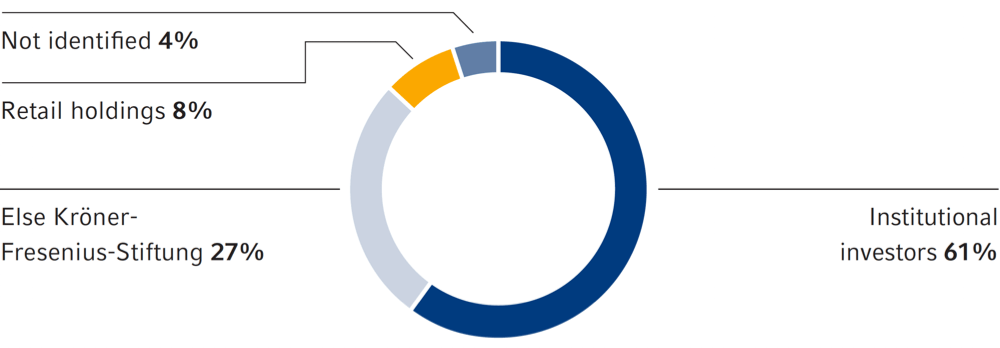

The Else Kröner-Fresenius-Stiftung was the largest shareholder of Fresenius SE & Co. KGaA, with 27% of the shares. According to notifications pursuant to the German Securities Trading Act (WpHG), BlackRock, Inc. held below 5% and Harris Associates L.P. above 3% of the shares. For further information on notifications, please visit www.fresenius.com/shareholder-structure.

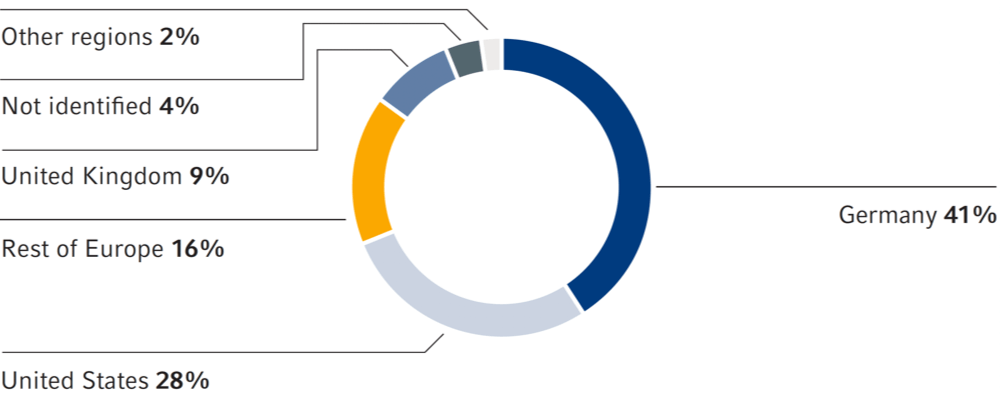

As of December 31, 2022, a shareholder survey identified the ownership of about 96% of our subscribed capital. A total of over 600 institutional investors held about 340 million shares or 61% (2021: 61%) of the subscribed capital; 45.5 million (2021: 48.1 million) shares were identified as retail holdings. The 10 largest investors held about 23% of the share capital (2021: 20%). Our shares were mostly held by investors in Germany, the United States, and the United Kingdom.

Shareholder structure by region

Shareholder structure by investors

Analyst recommendations

The recommendations published by financial analysts are an important guide for institutional and private investors when making investment decisions. According to our survey, as of February 18, 2023, we were rated with 11 “buy” and 7 “hold” recommendations.

Analyst recommendations