Letter to our shareholders

Fresenius set the strategic course and is moving towards #FutureFresenius with a simplified structure, sharper focus and acceleration of performance.

Read moreSustainability report

Fresenius is at the heart of healthcare. The well-being of our patients guides our actions. This applies to sustainability at all levels.

Read moreStrategy and management

Driving sustainability forward and thus creating a solid basis for future challenges is a joint task of the entire Fresenius Group.

Well-being of the patient

As a healthcare group, the safety and well-being of our patients is our top priority.

Diversity

At Fresenius, we create conditions for a diverse, inclusive and equal working environment in which employees can integrate well.

Employees

The commitment of our more than 300,000 employees worldwide is the foundation of our success.

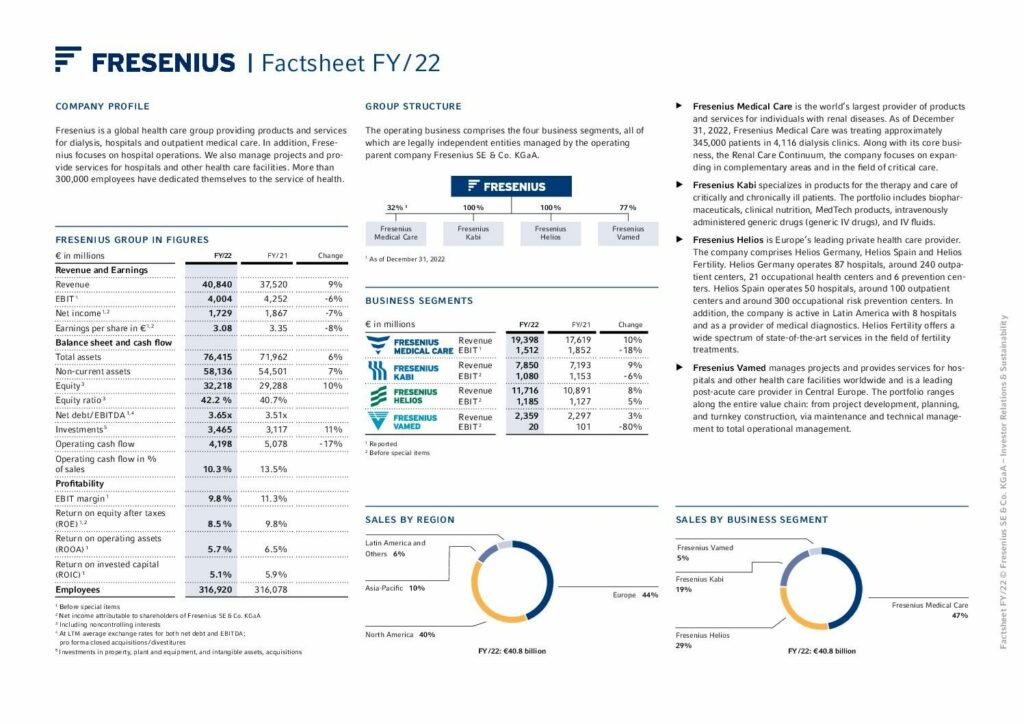

Financial Highlights FY/22

Despite a difficult macroeconomic environment, Fresenius met its FY 2022 revised Group sales and earnings targets.

To Group financial figures

Revenue

€ 37,520 m

+4 %1

FY/21: €37,520 m

Net interest2

€ -504 m

0%1

FY/21: € -504 m

EBIT2

€ 4,252 m

-11%1

FY/21: €4,252 m

Employees

316,078

Dec. 31, 2021: 316,078

Net income2,3

€ 1.867 m

-10%1

FY/21: €1,867 m

Earnings per share2

€ 3.35

-13%1

FY/21: €3,35

1 In constant currency

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Management Report

Fresenius is at the heart of healthcare. The focus here is on our services for patients, our clinical decisions, our drugs, our medical devices and technologies – and, above all, our patient care. Every day, our employees improve the quality of life for millions of people around the world.

To the management report