Financial management policies and goals

The financing strategy of the Fresenius Group has the following main objectives:

- Ensuring financial flexibility

- Maintaining our investment grade rating

- Limiting refinancing risks

- Optimizing the weighted average cost of capital

Assuring financial flexibility is key to the financing strategy of the Fresenius Group. Our investment grade rating provides us with good access to the capital and credit markets. Moreover, adequate liquidity headroom maintains our financial flexibility.

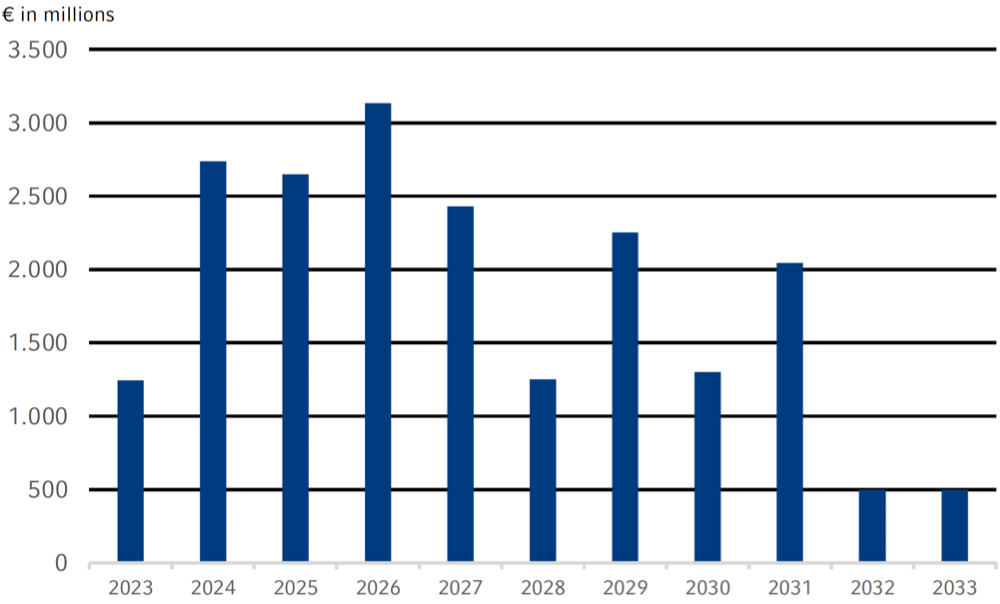

Our refinancing risks are limited due to a balanced maturity profile that is characterized by a broad spread of maturities with a high proportion of medium- and long-term financing up to 2033. In the selection of financing instruments, we take into account criteria such as market capacity, investor diversification, funding flexibility, credit conditions, cost of capital, and the existing maturity profile. We also take into account the currencies in which our income and cash flows are generated.

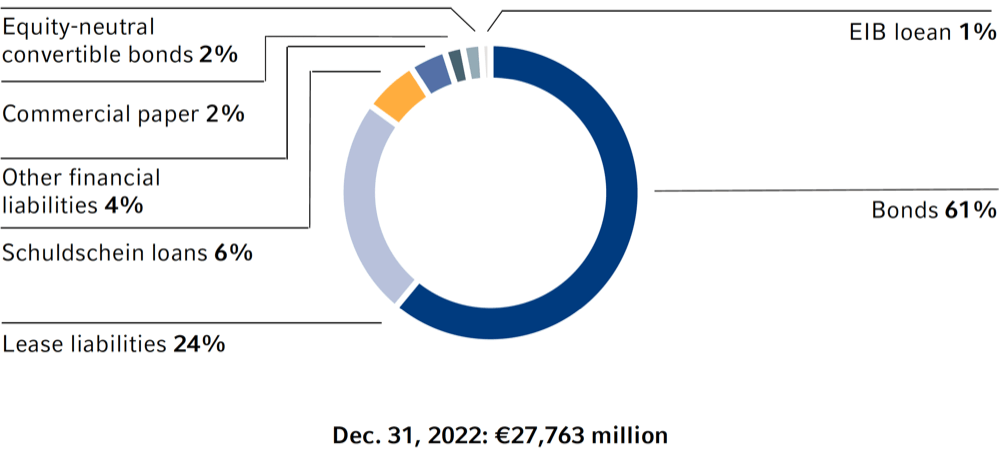

Financing mix of the Fresenius Group1

1 The syndicated revolving credit facilities of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA in the amount of €2 billion each were undrawn as of December 31, 2022 and are therefore not included in the chart.

Our main medium- and long-term financing instruments are bonds, as shown in the adjacent chart. Bonds denominated in euros are issued under the €12.5-billion Debt Issuance Program of Fresenius SE & Co. KGaA or the €10-billion Debt Issuance Program of Fresenius Medical Care AG & Co. KGaA. Other important long-term financing instruments include Schuldschein loans, bank loans, and an equity-neutral convertible bond. Short-term financing requirements are covered by issuances under the commercial paper programs of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA of €1.5 billion each and by bilateral credit lines. Moreover, lease liabilities (according to IFRS 16) as well as accounts receivable programs are part of our short- and medium-term financing. The syndicated credit facilities of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA signed in July 2021, each of €2 billion, serve as backup lines and were undrawn as of December 31, 2022.

Another main objective of the Fresenius Group’s financing strategy is to optimize the weighted average cost of capital by employing a balanced mix of equity and debt. Due to the Company’s diversification within the healthcare sector and the strong market positions of the business segments in global, growing, and non-cyclical markets, predictable and sustainable cash flows are generated. These allow for a reasonable proportion of debt. Measures to strengthen the equity base may also be considered in exceptional cases to support long-term growth.

Overall, there was no significant change in our financing strategy in 2022. Against the background of the volatile capital market environment, however, upcoming maturities were refinanced much earlier. For example, with the €1-billion bond issuance in November we already refinanced 2023 and parts of our 2024 maturities. The average maturity of our majorfinancing instruments (excluding leasing) as of December 31, 2022 was 4.4 years and the average cost of interest was 2.1%. In line with the Group’s structure, financing for Fresenius Medical Care and the rest of the Fresenius Group is conducted separately. There are no joint financing facilities and no mutual guarantees. The Fresenius Kabi, Fresenius Helios, and Fresenius Vamed business segments are financed primarily through Fresenius SE & Co. KGaA, in order to avoid any structural subordination.

Financing

Fresenius meets its financing needs through a combination of operating cash flows generated in the business segments and short-, mid-, and long-term debt. Important financing instruments include bonds, Schuldschein loans, bank loans, convertible bonds, commercial paper programs, and accounts receivable programs. In addition, our financing mix includes lease liabilities in accordance with IFRS 16. In 2022, the proceeds of the financing activities were mainly used for general corporate purposes, including the refinancing of existing financial liabilities.

Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA have Debt Issuance Programs, under which bonds of up to €12.5 billion (Fresenius SE & Co. KGaA) and up to €10 billion (Fresenius Medical Care AG & Co. KGaA) can be issued in different currencies and maturities. The syndicated credit facilities serve as backup lines and were undrawn as of December 31, 2022.

Maturity profile of the Fresenius Group financing facilities1,2

1 31. Dezember 2021, wesentliche Finanzierungsinstrumente, exklusive Commercial Paper1 31. Dezember 2021, wesentliche Finanzierungsinstrumente, exklusive Commercial Paper

2 Die variabel verzinste Tranche in Höhe von 175 Mio € der ursprünglich am 31. Januar 2024 fälligen Schuldscheindarlehen der Fresenius SE & Co. KGaA in Höhe von insgesamt 421 Mio € wurde vorzeitig am 31. Januar 2023 zurückgezahlt. Die Anleihe der Fresenius US Finance II, Inc. in Höhe von 300 Mio US$, die ursprünglich am 15. Januar 2023 fällig geworden wäre, wurde am 13. Dezember 2022 vorzeitig zurückgezahlt.

For short-term financing needs, Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA maintain bilateral credit lines and commercial paper programs. Under each of the commercial paper programs, short-term notes of up to €1.5 billion can be issued. As of December 31, 2022, €80 million of Fresenius SE & Co. KGaA’s commercial paper program were utilized. The commercial paper program of Fresenius Medical Care AG & Co. KGaA was utilized in the amount of €497 million.

To ensure short-term liquidity, both Groups can also conclude bilateral credit lines with banks that can be drawn at any time.

Financial position - Five-year overview

Download(XLS, 38 KB)| € in millions | 2022 | 2021 | 2020 | 2019 | 2017 |

|---|---|---|---|---|---|

| Operating cash flow | 4,198 | 5,078 | 6,549 | 4,263 | 3,742 |

| as % of sales | 10.3 | 13.5 | 18.1 | 12.0 | 11.2 |

| Working capital1 | 9,586 | 8,690 | 8,104 | 8,812 | 7,721 |

| as % of sales | 23.5 | 23.2 | 22.3 | 24.9 | 23.0 |

| Investments in property, plant and equipment, net | -1,777 | -2,017 | 2,366 | 2,433 | 2,077 |

| Cash flow before acquisitions and dividends | 2,421 | 3,061 | 4,183 | 1,830 | 1,665 |

| as % of sales | 5.9 | 8.2 | 11.5 | 5.2 | 5.0 |

| 1 Trade accounts receivable and inventories, less trade accounts payable and payments received on accounts. | |||||

Corporate rating

The credit quality of Fresenius is assessed and regularly reviewed by the leading rating agencies Moody’s, Standard & Poor’s, and Fitch. Fresenius is rated investment grade by all three rating agencies. The rating agency Fitch lowered the outlook from stable to negative in November 2022. Other than that, there were no rating changes in 2022.

Rating of Fresenius SE & Co. KGaA

Download(XLS, 35 KB)| Dec. 31, 2022 | Dec. 31, 2021 | |

|---|---|---|

| Standard & Poor’s | ||

| Corporate Credit Rating | BBB | BBB |

| Outlook | stable | stable |

| Moody’s | ||

| Corporate Credit Rating | Baa3 | Baa3 |

| Outlook | stable | stable |

| Fitch | ||

| Corporate Credit Rating | BBB- | BBB- |

| Outlook | negative | stable |

Effect of off-balance-sheet financing instruments on our financial position and liabilities

Fresenius is not involved in any off-balance-sheet transactions that are likely to have a significant impact on its financial position, results of operations, liquidity, investments, assets and liabilities, or capitalization at present or in the future.

Liquidity analysis

The main sources of liquidity are cash provided by operating activities and cash used in financing activities, i.e. short-, medium- and long-term borrowings. Cash flows from operating activities are influenced by the profitability of Fresenius' business and by working capitalWorking capitalCurrent assets (including deferred assets) - accruals - trade accounts payable - other liabilities - deferred charges., in particular receivables. Cash inflows from financing activities are generated through the use of various short-term financing instruments. To this end, we issue commercial paper and draw on bilateral bank credit lines. Short-term liquidity requirements can also be covered by accounts receivable programs. Medium- and long-term financing is mainly provided by bonds, Schuldschein loans, bilateral credit lines, an equity-neutral convertible bond and leasing liabilities. Fresenius SE & Co. KGaA has access to the €2 billion syndicated revolving credit facility as additional liquidity headroom. Fresenius is confident that the existing credit facilities, inflows from further debt financings as well as cash inflows from operating activities and other short-term financing sources will be sufficient to cover the Group's foreseeable liquidity needs.

Dividend

The general partner and the Supervisory Board will propose to the Annual General Meeting that the dividend will be kept stable compared with the previous year, despite the challenging year. This is intended to maintain dividend continuity.

For 2022, a dividend of €0.92 per share is proposed (2021: €0.92 per share). This results in a total payout of €518 million (2021: €514 million, thereof €147 million in shares as part of the scrip dividend).

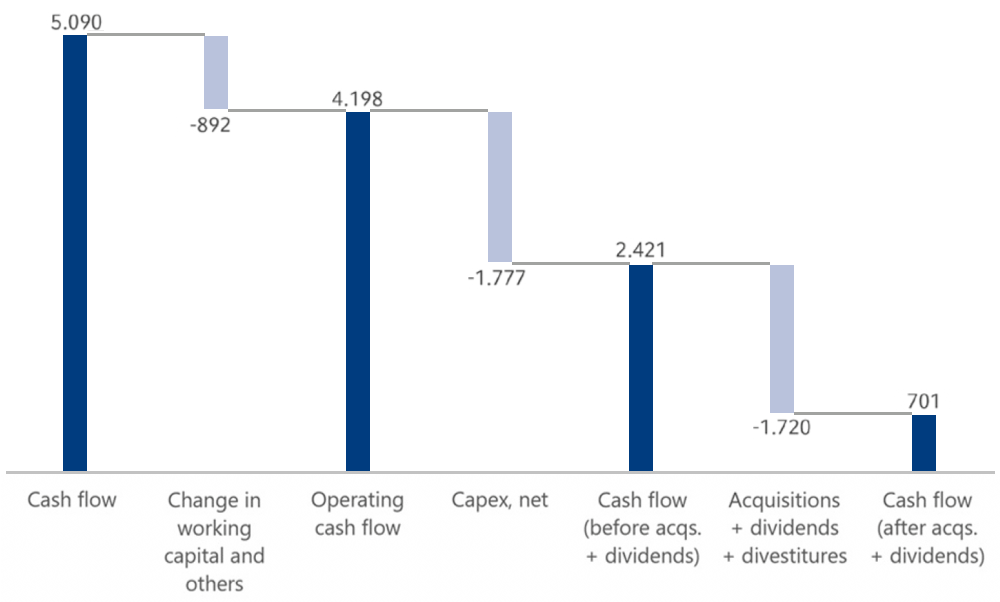

Cash flow analysis

Operating cash flow decreased by 17% to €4,1988 million (2021: €5,078 million), with a margin of 10.3% (2021: 13.5%). The cash flowCash flowFinancial key figure that shows the net balance of incoming and outgoing payments during a reporting period. development is mainly attributable to lower earnings and higher inventories.

Cash provided by operating activities exceeded financing needs from investment activities before acquisitions, with cash outflows for capital expenditures amounting to €1,917 million (2021: €2,047 million) and cash inflows from disposals of noncurrent assets of €140 million (2021: €30 million).

Cash flow before acquisitions and dividends was €2,421 million (2021: €3,061 million). This was sufficient to finance the Group dividends of €890 million.

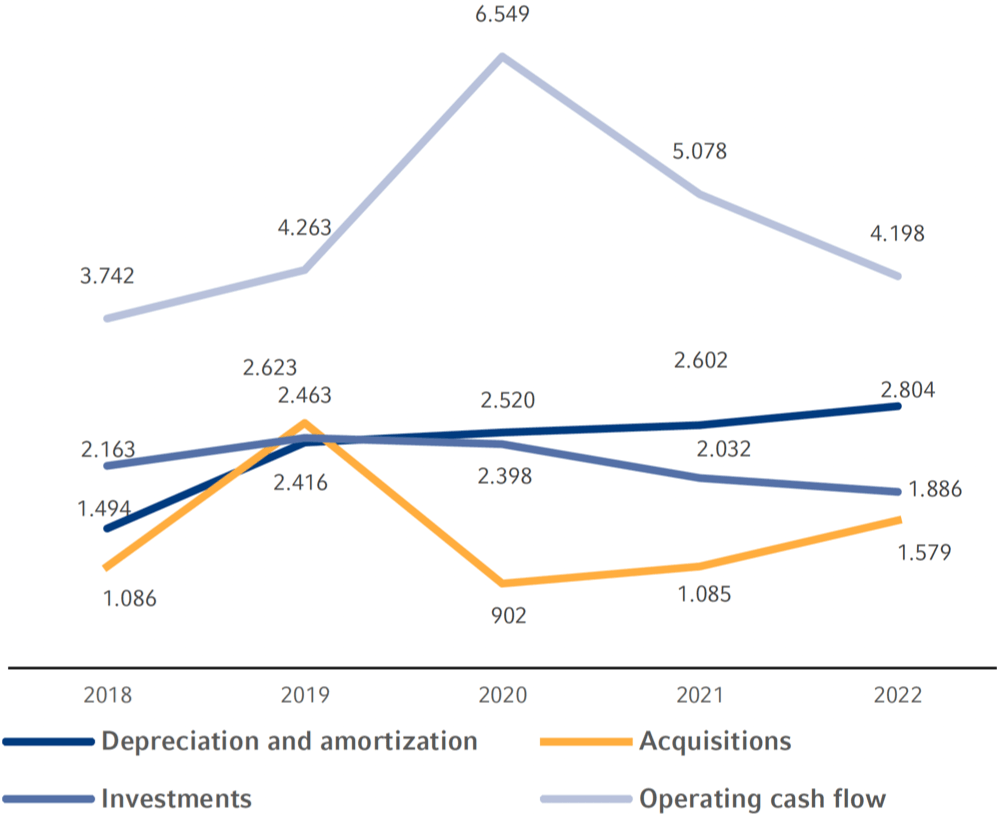

Cashflow in € millions

The dividend amount is calculated as follows:

in total, there was a dividend payment of €514 million to the shareholders of Fresenius SE & Co. KGaA. Of this amount, €147 million in dividend rights for new shares were contributed from Authorized Capital due to the scrip dividend and thus not substituted in cash. Group dividends consisted of dividend payments of €367 million to the shareholders of Fresenius SE & Co. KGaA, payments of €396 million by Fresenius Medical Care to its shareholders, and dividends paid to third parties of €254 million (primarily relating to Fresenius Medical Care). These payments were partially offset by the dividend of €127 million that Fresenius SE & Co. KGaA received as a shareholder of Fresenius Medical Care.

The cash outflow for acquisitions was €830 million, mainly for the acquisitions of mAbxience and Ivenix at Fresenius Kabi.

Cash flow after acquisitions and dividends was €701 million (2021: €1,193 million). Overall, cash used for financing activities was €714 million, (2021 cash used for financing activities: €384 million). Cash and cash equivalents decreased by €15 million to €2,749 million as of December 31, 2022 (December 31, 2021: €2,764 million). Cash and cash equivalents were negatively influenced by currency translation effects of -€2 million (2021: positive effect of €118 million).

Working capital increased by 10% to €9,586 million (2021: €8,690 million), mainly due to higher inventories.

Cash flow statement (summary)

Download(XLS, 35 KB)| € in millions | 2022 | 2021 | Growth | Margin 2022 | Margin 2021 |

|---|---|---|---|---|---|

| Net income | 2,117 | 2,819 | -25% | ||

| Depreciation and amortization | 2,973 | 2,667 | 11% | ||

| Change in working capital and others | -892 | -408 | -119% | ||

| Operating cash flow | 4,198 | 5,078 | -17% | 10.3% | 13.5% |

| Capital expenditure, net | -1,777 | -2,017 | 12% | ||

| Cash flow before acquisitions and dividends | 2,421 | 3,061 | -21% | 5.9% | 8.2% |

| Cash used for acquisitions / proceeds from divestitures | -830 | -800 | -4% | ||

| Dividends paid | -890 | -1,068 | 17% | ||

| Free cash flow after acquisitions and dividends | 701 | 1,193 | -41% | ||

| Cash provided by / used for financing activities | -714 | -384 | -86% | ||

| Effect of exchange rates on change in cash and cash equivalents | -2 | 118 | -102% | ||

| Net change in cash and cash equivalents | -15 | 927 | -102% |

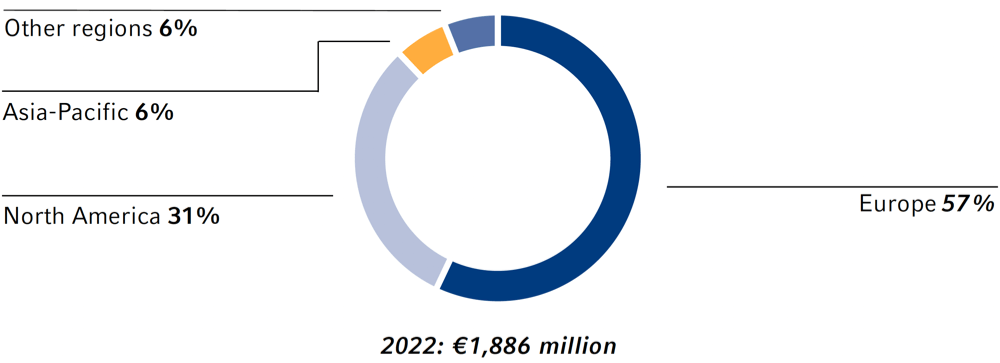

Investments and acquisitions

In 2022, the Fresenius Group spend €3,465 million (2021: €3,117 million) for investments and acquisitions. Investments in property, plant and equipment decreased to €1,886 million (2021: €2,032 million). At 4.6% of reported revenue (2021: 5.4%), this was below the depreciation level1 of €2,804 million. A total of €1,579 million was invested in acquisitions (2021: €1,085 million). Of the total capital expenditure in 2022, 54% was invested in property, plant and equipment and 46% was spent on acquisitions.

1 Before special itemsBefore special itemsIn order to measure the operating performance extending over several periods, key performance measures are adjusted by special items, where applicable. Adjusted measures are labelled with “before special items”. A reconciliation table is available within the respective quarterly or annual report and presents the composition of special items.

Investments by region

Investments and acquisitions

Download(XLS, 35 KB)| € in millions | 2022 | 2021 | Change |

|---|---|---|---|

| Acquisitions | 1,579 | 1,085 | 46% |

| Investment in property, plant and equipment | 1,886 | 2,032 | -7% |

| thereof maintenance | 59% | 58% | |

| thereof expansion | 41% | 42% | |

| Investment in property, plant and equipment as % of revenue | 4.6% | 5.4% | |

| Total investments and acquisitions | 3,465 | 3,117 | 11% |

The cash outflow for acquisitions is primarily related to the following business segments:

- Fresenius Medical Care’s acquisition spending was mainly related to the business combination of InterWell Health as well as the acquisition of dialysisDialysisForm of renal replacement therapy where a semipermeable membrane – in peritoneal dialysis the peritoneum of the patient, in hemo dialysis the membrane of the dialyzer – is used to clean a patient’s blood. clinics.

- Fresenius Kabi acquired a majority stake in mAbxience Holding S.L., a leading international biopharmaceutical company, and Ivenix Inc., a specialized infusion therapy company, in 2022. Fresenius Kabi’s acquisition spending was also for acquisition-related milestone payments for the acquisition of the biosimilarsBiosimilarsA biosimilar is a drug that is “similar” to another biologic drug already approved. business from Merck KGaA.

- Fresenius Helios’ acquisition spending was mainly for the acquisition of clinics in Latin America.

Investments and acquisitions by business segment

Download(XLS, 35 KB)| € in millions | 2022 | 2021 | Thereof property, plant and equipment | Thereof acquisitions | Change | % of total |

| Fresenius Medical Care | 1,470 | 1,482 | 724 | 746 | -1% | 42% |

| Fresenius Kabi | 1,243 | 533 | 509 | 734 | 133% | 36% |

| Fresenius Helios | 642 | 1,021 | 560 | 82 | -37% | 19% |

| Fresenius Vamed | 96 | 81 | 79 | 17 | 19% | 3% |

| Corporate / Other | 14 | 0 | 14 | 0 | - | 0% |

| Total | 3,465 | 3,117 | 1,886 | 1,579 | 11% | 100% |

Investments, Acquisitions, operating Cash Flow, Depreciation and Amortization in € millions – Five-Year Overview1

Acquisitions at Fresenius Kabi

In 2022, Fresenius Kabi acquired a majority stake of 55% in mAbxience Holding S.L. (“mAbxience”) for €499 million and milestone payments, which are tied to the achievement of future commercial and development targets. mAbxience is an international biopharmaceutical company, specialized in the rapidly developing biosimilars market. The company has established itself as a strong player in the development and manufacturing of biological drugs, with two commercialized biosimilar products (Rituximab and Bevacizumab) and a mid-single-digit number of molecules across immunology and oncology. This is supported by internal R & D laboratories and state-of-the-art manufacturing facilities in Spain and Argentina. In addition to very competitive production costs for the manufacture of its own products, the manufacturing platform of mAbxience allows the company to offer third-party biological contract development and manufacturing organization (CDMO) services. mAbxience operates three state-of-the-art manufacturing plants for the production of biological drug substances. This addresses a critical gap in Fresenius Kabi’s value chain, adding flexible, single-use biological drug substance capacity that can be leveraged to provide competitive cost of production for the enlarged biosimilars portfolio of Fresenius Kabi. The acquisition is part of Fresenius Kabi´s Vision 2026 and targets one of three growth vectors to broaden its biopharmaceuticals business.

Furthermore, Fresenius Kabi acquired Ivenix Inc., a specialized infusion therapy company, in 2022 to expand its MedTech business. Ivenix has developed a technologically advanced infusion system including a large-volume pump (LVP) with administration sets, infusion management software tools, applications, and analytics to improve care and advance efficiency. The Ivenix infusion system’s innovative design and architecture sets a new standard in infusion safety, simplicity, and interoperability. The system is centered around the patient, nursing staff, and clinician and is designed to reduce infusion-related errors and drive down the total cost of ownership. The Ivenix’ infusion system provides access to attractive development potential for Fresenius Kabi in the large and growing infusion therapy market. The combination of Ivenix’s leading hardware and software products with Fresenius Kabi’s offerings in intravenous fluids and infusion disposables will create a comprehensive and leading portfolio of premium products, forming a strong basis to enable sustainable growth in the high-value MedTech business. Fresenius Kabi acquired Ivenix for US$240 million (€228 million) and subsequent milestone payments, which are linked to the achievement of future commercial and operating targets.

Acquisitions at Fresenius Helios

In January 2022, Quirónsalud, Spain´s largest private hospital operator, owned by Fresenius Helios, completed the acquisition of the specialty hospitals Centro Oncológico de Antio-quia (COA) and Clínica Clofán. The clinics, located in Colombia´s second largest city, Medellín, expand the existing Quirónsalud network, which already includes 6 hospitals and 10 diagnostic centers in the country. The two clinics will be consolidated as of February 2022.

COA is a clinic specializing in the diagnosis and treatment of cancer, with 75 beds, 4 operating rooms and focus centers for nuclear medicine, radiotherapy, and bone marrow transplantation.

Clínica Clofán is the second largest eye clinic in the city, with 10 operating rooms and other specialized facilities, where severe chronic eye diseases can be treated and complicated procedures can be performed.

Both hospitals offer their patients the latest medical technology and the most modern medical standards and, with their renowned medical staff, are regarded as leading institutions in their field. Together, they generated revenue of around €30 million in 2020. Both clinics already contributed positively to Fresenius Helios´ earnings in 2022.

Helios Fertility, which forms a separate business and operating unit alongside Helios Germany and Helios Spain, offers a wide range of state-of-the-art services in the field of reproductive medicine. The company acquired various smaller clinics in the reporting year totaling to around €11 million, including in the important Brazilian market.

Acquisitions at Fresenius Medical Care

On August 24, 2022, Fresenius Medical Care announced that it has completed the business combination to form InterWell Health. The business combination of InterWell Health, Fresenius Health Partners and Cricket Health created the leading provider of value-based renal therapy in the United States. This is expected to significantly improve care for people with kidney disease and further strengthen the company's leading position in value-based care. The net gain related to InterWell Health resulted in a positive effect on net income of €12 million in 2022 and is treated as a special item.

The main investments in property, plant and equipment were as follows:

- Most of the investments in property, plant and equipment related to the maintenance of existing clinics and centers, dialysis machines provided to customers, capitalizable development costs, equipment for new clinics and centers, and IT implementation costs at Fresenius Medical Care.

- Optimization and expansion of production facilities for Fresenius Kabi.

- New building and modernization of hospitals at Fresenius Helios. The most significant individual projects were, among other locations, hospitals in Wiesbaden, Duisburg, Wuppertal, and Niederberg, and investments in IT infrastructure.

Investments in property, plant and equipment of €226 million will be made in 2023, to continue with major ongoing investment projects. These are investment obligations at Fresenius Helios. These projects will be financed from operating cash flowOperating cash flowOperating cash flow is a financial measure showing cash inflows from operating activities during a period. Operating cash flow is calculated by subtracting non-cash income and adding non-cash expenses to net income..

Investment program at Fresenius Kabi

Fresenius Kabi has a global network of production centers. We manufacture our finished medicines in our own plants and, at some sites, also produce active pharmaceutical ingredients. Our investments aim, among other things, to continuously modernize and automate as well as to increase the competitiveness of the plants at a consistently high level of quality.

In the United States, Fresenius Kabi continued its extensive investment program at the manufacturing sites. In 2022, we continued equipping our plants with the latest technologies for the production of pharmaceutical products.

Due to the demand for enteral nutrition products in China, we are expanding our production capacity there. At completion we will have invested around €100 million (including investments from prior years), primarily to expand capacity. In 2022, we continued work on a new production building on our campus in Wuxi. In the future, we will be producing enteral nutrition products there that have the status of Food for Special Medical Purposes. Fresenius Kabi will also be expanding its research and development activities for enteral nutritionEnteral nutritionApplication of liquid nutrition as a tube or sip feed via the gastrointestinal tract. at the Wuxi site.

In the Netherlands, we are converting our site in Emmer-Compascuum into a production facility for enteral nutrition products and will invest a total of around €160 million in this manufacturing site. The production build-up and capacity expansion have been started successfully.

In Austria, we continued to expand our production and logistics site in Graz. In the manufacturing plant, the mobile preparatory area will be enlarged, freeze-drying (lyophilization) expanded, and new filling systems implemented. With capital expenditure of around €110 million, we will continue to expand this site. The plant manufactures sterile drugs such as intravenously administered drugs and large-volume products for parenteral nutrition; the site also specializes in complex process requirements and innovative technologies.

In France, we continued with the modernization of our plant in Louviers. We plan to complete a new building comprising an area of 3,300 square meters for the production of freeflex infusion bags there. This also allows us to further optimize the European production network as a whole. In total, we will be investing €35 million in the modernization.

In Germany, a new KabiClear production line is being installed at our Friedberg plant to meet the increasing demand in the infusion bottles business in Europe. A total of €40 million is expected to be invested in the course of this project.

Our Haina plant in the Dominican Republic is the central manufacturing facility for disposable products in the field of apheresisApheresisA medical technology in which the blood of a person is passed through a device that separates out one particular blood component and returns the remainder to the circulation. This technology is used for the collection of various blood components by donors, as well as for therapeutic applications for patients. and cell therapy. Driven by the high market demand for plasma and cell therapy products, we have gradually expanded the plant in recent years. In the plasma collection business, in addition to disposable products for our Aurora plasmapheresis system, the disposable products of the successor system, Aurora Xi, are also produced in Haina. In 2022, a new building was inaugurated at the facility. We are now also working on relocating production of our Comtec and Ivenix sets to this plant.

In order to continue to meet the growing market demand for disposable products, we intend to expand our manufacturing plant in the coming years with highly automated production facilities and clean-room capacities. In total, we expect to invest approximately US$80 million in the Haina plant going forward.