#FutureFresenius

In 2022, we launched our program #FutureFresenius to further develop our Group and define its course. Our goal is to expand Fresenius’ position as a leading global provider of therapies, improve patient care, and generate sustainable value for our stakeholders.

Ready for RESET

RESET – The strategic course is set

In the first phase on our pathway to #FutureFresenius, we set the course for simplifying our Group structure, optimizing corporate management and fostering a momentum of change within the organization.

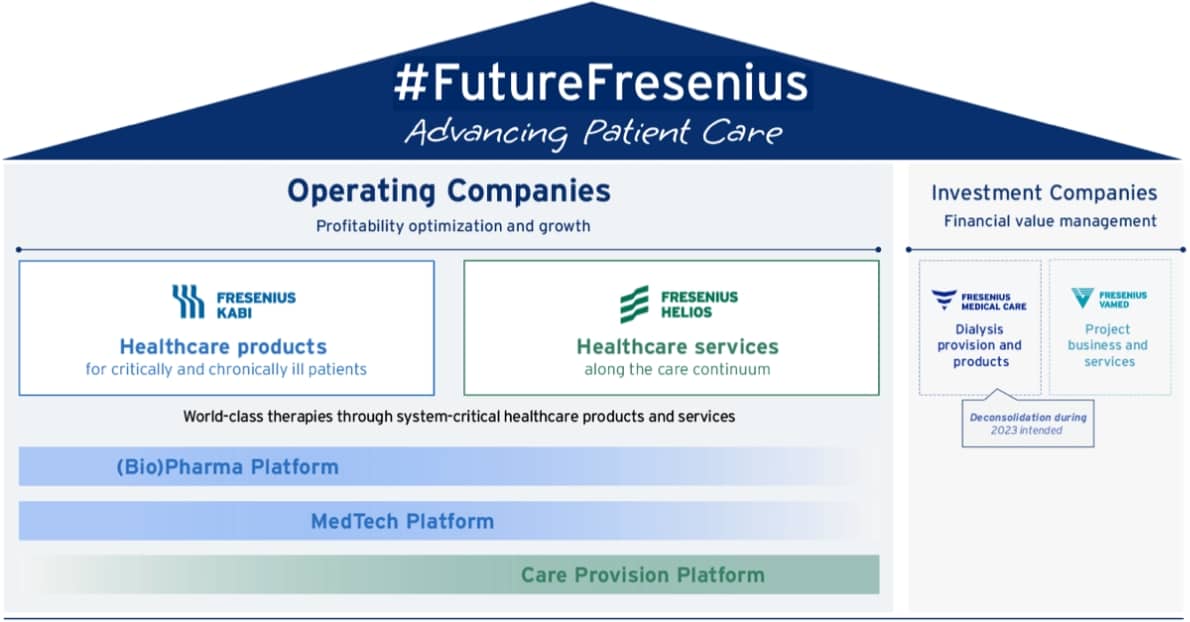

Through the planned deconsolidation of Fresenius Medical Care, we will simplify our governance and Group structure. The company will have a clear focus on therapy to advance patient care across the three platforms (Bio)Pharma, MedTech and Care Provision.

To enable and accelerate performance, the Management Board set up a new, more rigorous Fresenius Financial Framework. The framework sets new ambitious EBITEBIT (Earnings before Interest and Taxes)EBIT does include depreciation and write-ups on property, plant and equipment. EBIT is calculated by subtracting costs of revenue, selling, general and administrative expenses, and research and development expenses from revenue. margin bands for the business segments. They serve as a benchmark when reviewing performance. At Group level, we will measure our future performance based on return on invested capital (ROICROIC (Return on Invested Capital)Calculated by: (EBIT - taxes) / Invested capital. Invested capital = total assets + accumulated amortization of goodwill - deferred tax assets - cash and cash equivalents - trade accounts payable - accruals (without pension accruals) - other liabilities not bearing interest.), a leverage target band and the cash conversion rate (CCR), among others.

Our goal is to implement new ways of working worldwide, establishing a culture of excellence. We aim to continuously pick up the pace of change and improvement and use this momentum to create #FutureFresenius.

„This great company with its highly committed employees offers outstanding potential.“

Michael Sen, CEO of Fresenius

Portfolio focus

Two Operating Companies - Our key priorities

We have executed a comprehensive diagnosis of our Group portfolio at sub-segment level and identified growth opportunities. These initiatives will enable us to improve our business management and strengthen our portfolio focus.

Going forward, we want to increasingly orient our portfolio along 3 platforms:

(Bio)Pharma – including clinical nutrition, MedTech and Care Provision.

With these platforms, we capture the major trends in healthcare and develop Fresenius towards a more therapy-focused company. At the same time, our platforms address attractive value pools in healthcare, which will provide opportunities for future profitable growth.

Focus on Operating Companies Fresenius Kabi and Fresenius Helios

The Operating Companies Fresenius Kabi and Fresenius Helios are at the center of the Group’s ambitions under #FutureFresenius.

Building on a resilient global generics business, Fresenius Kabi will expand along its three growth vectors Nutrition, Biopharma and MedTech.

Helios Germany and Quirónsalud are already the leading private hospital providers in Germany and Spain, caring for more than 24 million patients every year. Fresenius Helios intends to leverage its market position to actively shape industry trends across digitalization and integrated care.

For the Investment Companies Fresenius Medical Care and Fresenius Vamed, there will be a strong focus on active financial value management.

Clear financial priorities to accelerate performance and deliver value to shareholders

Financial priorities to deliver #FutureFresenius

Focus and Transparency

Increase focus and transparency with clear set of KPIs and upcoming CMDs

Structural productivity

Improve structural productivity to reach around €1 bn cost savings by 2025E

Capital allocation

Conduct business-cell specific capital allocation and active portfolio management

Cash and ROIC focus

Reinvigorate focus on ROIC and Cash Conversion

Shareholder return

Deliver shareholder return via progressive dividend policy

Deleveraging

Delever to 3.0x – 3.5x target corridor and deliver on IG commitment

Structural Productivity

~€1bn structural productivity improvement p.a. by 2025

With structural productivity improvements, we aim to offset market headwinds and create financial flexibility for future growth investments in the coming years.

Our new target is to achieve annual structural cost savings of around €1 billion at EBIT level from the fiscal year 2025 onwards.

In order to reach this goal, we are running targeted programs across all business segments and the Corporate Center with the oversight and steering of the Group. Key elements include measures to optimize processes, reduce administrative, sales and procurement costs, as well as divesting from non-core assets.

Making Fresenius fit for future

On our pathway to #FutureFresenius

Initiated by the RESET, decisive steps on our pathway to #FutureFresenius have been made and the strategic course has been set. Now, we will move on and take the next steps. Steps to improve patient care and create sustainable value for our stakeholders.

Our next milestones for implementation are:

-

Revitalize

Continuously optimizing the portfolio and developing new growth areas -

Rejuvenate

Using value-generating growth opportunities to strengthen and expand our platforms -

Reimagine

Actively shaping the future of the healthcare industry

As we proceed with the implementation, all of our activities will be guided by our core principles: simplification, performance, and focus. Aligned with our commitment to advancing patient care, we will continue to shape the future of healthcare by leveraging our expertise as a leading, therapy-focused healthcare company.

Contact

Fresenius SE & Co. KGaA

Investor Relations & Sustainability

+49 (0) 6172 608-2485

ir-fre@fresenius.com