CEO video messages

Fresenius’ stance on the war in Ukraine

The war in Ukraine is a disaster in every respect. First and foremost a humanitarian one. We at Fresenius stand deeply shocked and condemn this war of aggression in the strongest possible terms. We stand by the Ukrainians. Our concerns and thoughts go out to them and to all those directly or indirectly affected by this war. But also our actions.

As a healthcare company, we will do everything we can to support the people. First on the ground. But also wherever they have to flee to. We are determined to maintain patient care in Ukraine. Because the patients there depend on the supply of our vital and life-saving products and services. That is our duty, our mission. Our corporate purpose "ever better medicine for ever more people".

We are working hard to supply hospitals in Ukraine with vital emergency care products, urgently needed blood products and medicines through a humanitarian aid organization. We also maintain patient care in our dialysis centers on the ground. Despite all adversities. And are working hard to replenish our stocks of consumable materials.

We hope for understanding. We sincerely wish for an end of violence and for peace in the region.

Our deepest gratitude and most sincere appreciation goes out to all our colleagues who are tirelessly - at the risk of their lifes – ensure continued patient care under those extraordinary circumstances.

Business performance in 2021

2021 was a good year for us in light of the general circumstances of the pandemic. We were able to increase sales by 5 percent in constant currency. We were also able to increase net income, as well by 5 percent in constant currency. This was more than we had expected at the beginning of the year.

It took a tremendous effort from all of us to deliver this growth in a period still subject to significant COVID-19 headwinds.

We continue to face highly stressed, sometimes even disrupted supply chains and logistics challenges. And with sometimes significant price increases on almost our entire cost base. These price increases can only be passed on to a limited extent - if at all - in the short term in the markets in which we operate.

Thanks to our employees and their great work, we were able to overcome these challenges last year. And we are confident that we will also succeed in 2022.

Dividend proposal for 2021

We also maintain our dividend policy this year by proposing an increase of 5 percent to 92 cents per share. This would mark our 29th consecutive dividend increase.

For the first time we are proposing a scrip dividend. This means that we give our shareholders the choice: They can receive their dividend in cash as usual. Or they can receive it in the form of new Fresenius shares. This is a simple and easy way to further invest into our company.

The Else Kröner-Fresenius Foundation has already informed us that it intends to fully participate in the scrip dividend. A strong signal of support that we very much welcome.

Expectations for 2022 and beyond

COVID continues to be a determining factor for us. We have to assume that the pandemic will continue to have a noticeable impact on our business in 2022. How much depends, among other things, on the progress of vaccination in our relevant markets. And, of course, whether there will be further hazardous virus variants. To the extent possible we have taken this into account in our forecast for 2022. As of now, we expect to increase sales by a mid single-digit percentage in constant currency. For net income1, we expect a low single-digit percentage increase, also in constant currency.

We also confirmed and specified our medium-term targets, which we had set before the pandemic started. Compounded annual organic sales growth is expected between 4 and 7 percent in the period 2020 to 2023. For Group net income1, we expect a compounded annual organic growth between 5 and 9 percent. At the same time, we are specifying our expectations: We now expect to reach the bottom to mid part of the sales CAGR range and the bottom end of the net income CAGR range.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA, before special items

Our path to accelerated growth

A year ago, we started our journey to become an even more agile healthcare group. Our clear strategic growth path guides the future of Fresenius pursuing and executing on accelerated profitable growth, strengthening the Group and all its business segments by optimizing capital allocation and tapping new capital sources.

We have started implementing our cost reduction and efficiency program. We are making good progress. Even faster than originally expected. This means we are saving even more than originally expected, even earlier than anticipated. That is why we were able to significantly increase our cost savings target to more than 150 million euros - after taxes and minority interests by 2023. And thereafter, we are aiming for even higher sustainable cost savings.

On our ESG efforts we also have made significant progress.

Important sustainability achievements

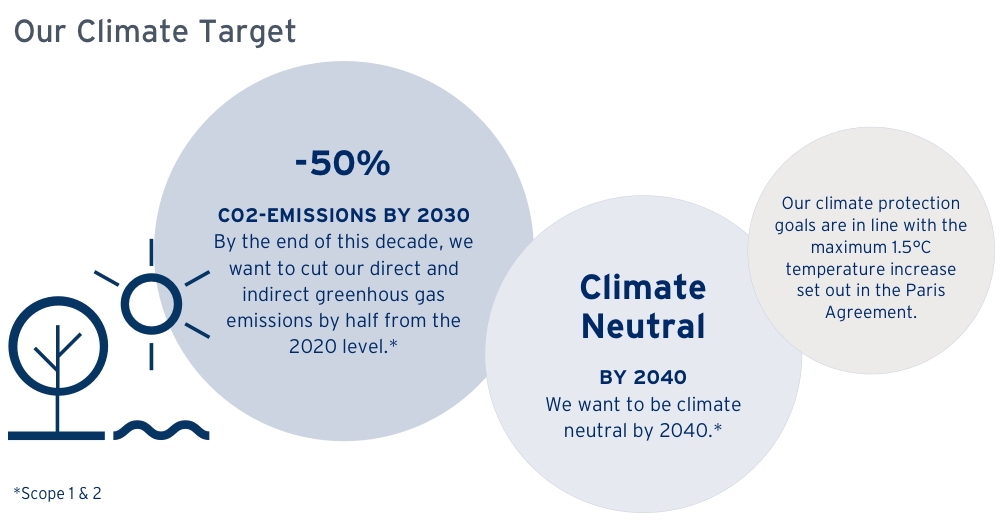

A milestone in our sustainability efforts is the announcement of a Group climate target complementing our existing sustainability targets and programs. We aim to be climate neutral by 2040 and to cut our direct and indirect greenhouse gas emissions in half by 2030, coming from around 1.5 million tons in 2020. Our targets are aligned with the science-based targets of the Paris Climate Agreement to limit global warming to 1.5 degrees Celsius.

And how are we going to accomplish these ambitious goals? The key will be to continue switching our global electricity consumption over to renewable electricity. There are many attractive options available in the market for long-term investments and commitments in renewables. In addition, we will continue working to make our hospitals and production sites more energy efficient over time and look at every capex investment from the green perspective. We will also continue to install renewable energy capacity on and around our own buildings, whenever this is economically and ecologically feasible.

We have also done efforts around the new EU Taxonomy: While our core business model, and therefore our revenue, is not yet included in the economic activities defined by the European Union, we have identified 49 percent of our capex as eligible within the Taxonomy framework. As a large share of our capex goes into the construction and renovation of hospitals and clinics, our ambition is to ensure that these investments will be increasingly compliant with green building standards.

Moreover, we’ve been spending an increasing amount of time on making our sustainability performance more visible and more measurable. This has also been recognized by the rating agencies and has led to a better rating relative to the sector average.

In 2021, for the first time, 15 percent of the short-term variable compensation of the Management Board was tied to ESG. Our teams have diligently identified KPIs to appropriately quantify our performance in the most relevant sustainability areas. In 2022, we will solidify those KPIs and make them part of a broader sustainability reporting package.

So, all in all, we have made significant progress across the board on our ESG agenda.

Contact

Fresenius SE & Co. KGaA

Investor Relations & Sustainability

+49 (0) 6172 608-2485

ir-fre@fresenius.com