Financial management policies and goals

The financing strategy of the Fresenius Group has the following main objectives:

- Ensuring financial flexibility

- Limiting refinancing risks

- Optimizing the weighted average cost of capital

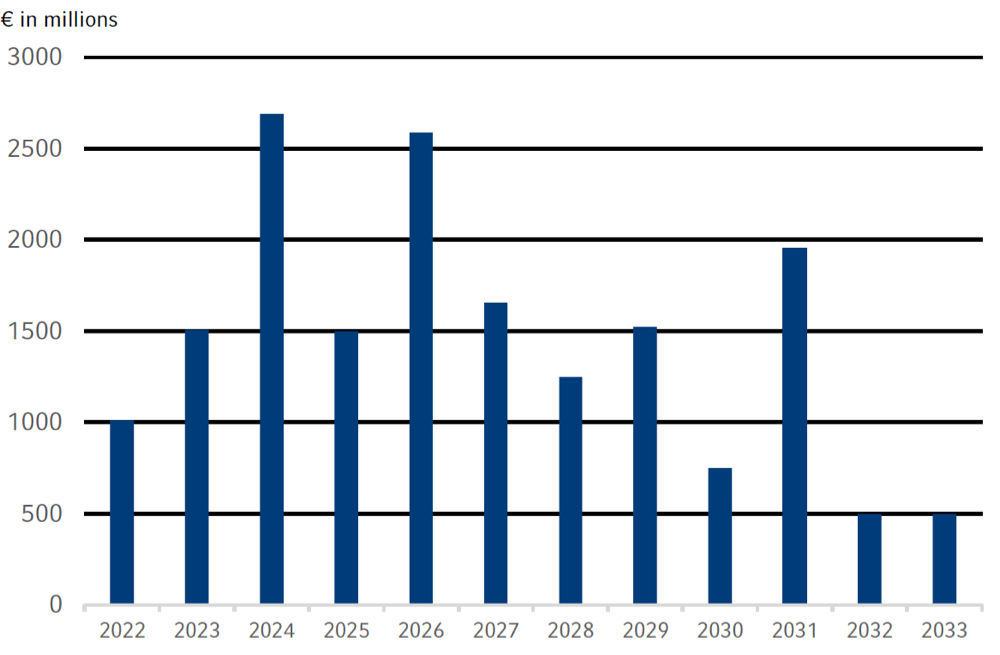

Assuring financial flexibility is key to the financing strategy of the Fresenius Group. An adequate liquidity headroom maintains our financial flexibility. Our refinancing risks are limited due to a balanced maturity profile that is characterized by a broad spread of maturities with a high proportion of medium- and long-term financing up to 2033. In the selection of financing instruments we take into account criteria such as market capacity, investor diversification, funding flexibility, credit conditions, cost of capital, and the existing maturity profile. We also take into account the currencies in which our income and cash flows are generated.

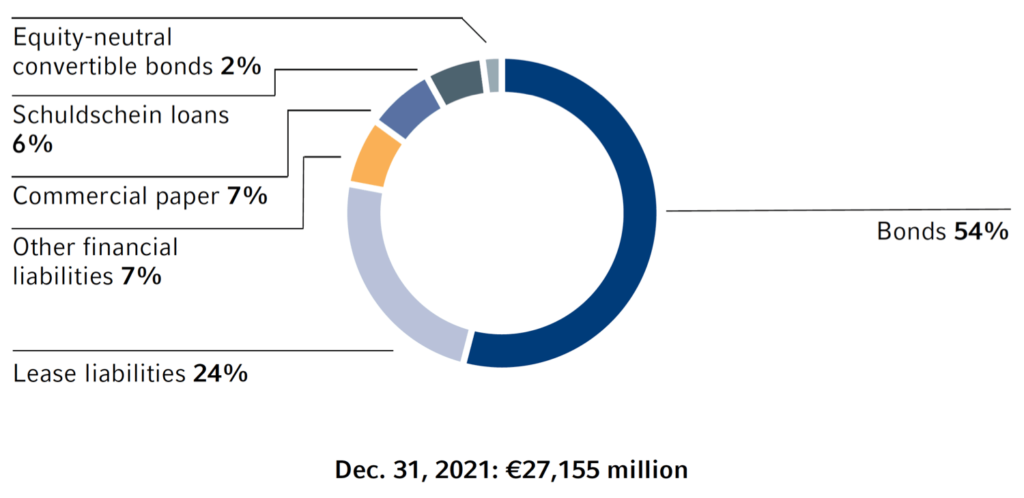

Our main medium- and long-term financing instruments are bonds, as shown in the adjacent chart. Bonds denominated in euros are issued under our €12.5-billion Debt Issuance Program.

Fresenius Medical Care AG & Co. KGaA has a €10 billion Debt Issuance Program. Other important long-term financing instruments include Schuldschein loans, bilateral loans, and an equity-neutral convertible bond, as well as leases (according to IFRS 16).

Financing mix of the Fresenius Group

1 The syndicated revolving credit facility of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA in the amount of €2 billion each were undrawn as of December 31, 2021 and are therefore not included in the chart.

Short-term financing requirements are covered by issuances under the commercial paper programs of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA of €1.5 billion each and by bilateral credit lines. The Fresenius Medical Care accounts receivable securitization program offers additional financing options. The syndicated credit facilities of Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA signed in July 2021, each of €2 billion, serve as back-up lines and were undrawn as of December 31, 2021.

Another main objective of the Fresenius Group’s financing strategy is to optimize the weighted average cost of capital by employing a balanced mix of equity and debt. Due to the Company’s diversification within the health care sector and the strong market positions of the business segments in global, growing, and non-cyclical markets, predictable and sustainable cash flows are generated. These allow for a reasonable proportion of debt. Measures to strengthen the equity base may also be considered in exceptional cases to ensure long-term growth, for example to finance a major acquisition.

Overall, there was no significant change in our financing strategy in 2021. The average maturity of our majorfinancing instruments (excluding leasing) as of December 31, 2021 was 4.5 years and the average cost of interest was 1.6%. In line with the Group’s structure, financing for Fresenius Medical Care and the rest of the Fresenius Group is conducted separately. There are no joint financing facilities and no mutual guarantees. The Fresenius Kabi, Fresenius Helios, and Fresenius Vamed business segments are financed primarily through Fresenius SE & Co. KGaA, in order to avoid any structural subordination.

Financing

Fresenius meets its financing needs through a combination of operating cash flows generated in the business segments and short-, mid-, and long-term debt. Important financing instruments include bonds, Schuldschein loans, bank loans, convertible bonds, commercial paper programs, and an accounts receivable securitization program. In addition, our financing mix includes lease liabilities in accordance with IFRS 16. Financing activities in the past fiscal year were mainly carried out to refinance existing financial liabilities and to optimize financing costs.

Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA have Debt Issuance Programs, under which bonds of up to €12.5 billion (Fresenius SE) and up to €10 billion (Fresenius Medical Care) can be issued in different currencies and maturities. The syndicated credit facilities serve as back-up lines and were undrawn as of December 31, 2021.

Maturity profile of the Fresenius Group financing facilities

1 As of December 31, 2021, and based on utilization of major financing instruments, excl. Commercial Paper

2 Fresenius’ €372 million Schuldschein loan due in January 2022 and Fresenius Medical Care’s US$700 million bonds also due in January 2022 were redeemed at maturity.

For short-term financing needs, Fresenius SE & Co. KGaA and Fresenius Medical Care AG & Co. KGaA maintain bilateral credit lines and commercial paper programs. Under each of the commercial paper programs, short-term notes of up to €1.5 billion can be issued. As of December 31, 2021, €1,056 million of Fresenius SE & Co. KGaA’s commercial paper program were utilized.

The commercial paper program of Fresenius Medical Care AG & Co. KGaA was utilized in the amount of €715 million.

In addition, both Groups can conclude short-term bilateral credit lines as needed.

The committed bilateral credit lines, that were entered into in 2020 in light of the COVID-19-related general uncertainties, have expired and have not been extended.

Detailed information on the Fresenius Group’s financing can be found in the Notes.

Further information on financing measures in 2022 is included in the Outlook section.

Financial position - Five-year overview

Download(XLS, 35 KB)| in Mio. € | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|

| Operating Cashflow | 5,078 | 6,549 | 4,263 | 3,742 | 3,937 |

| as % of sales | 13.5 | 18.1 | 12.0 | 11.2 | 11.6 |

| Working Capital1 | 8,690 | 8,104 | 8,812 | 7,721 | 7,771 |

| as % of sales | 23.2 | 22.3 | 24.9 | 23.0 | 22.9 |

| Investments in property, plant and equipment, net | -2,017 | 2,366 | 2,433 | 2,077 | 1,705 |

| Cash flow before acquisitions and dividends | 3,061 | 4,183 | 1,830 | 1,665 | 2,232 |

| as % of sales | 8.2 | 11.5 | 5.2 | 5.0 | 6.6 |

Corporate rating

The credit quality of Fresenius is assessed and regularly reviewed by the leading rating agencies Moody’s, Standard & Poor’s, and Fitch. Fresenius is rated investment grade by all three rating agencies. There were no rating changes in 2021.

Rating of Fresenius SE & Co. KGaA

Download(XLS, 35 KB)| Dec. 31, 2021 | Dec. 31, 2020 | |

|---|---|---|

| Standard & Poor’s | ||

| Corporate Credit Rating | BBB | BBB |

| Outlook | stable | stable |

| Moody’s | ||

| Corporate Credit Rating | Baa3 | Baa3 |

| Outlook | stable | stable |

| Fitch | ||

| Corporate Credit Rating | BBB- | BBB- |

| Outlook | stable | stable |

Effect of off-balance-sheet financing instruments on our financial position and liabilities

Fresenius is not involved in any off-balance-sheet transactions that are likely to have a significant impact on its financial position, results of operations, liquidity, investments, assets and liabilities, or capitalization at present or in the future.

Liquidity analysis

In general, key sources of liquidity are operating cash flows and cash inflow from financing activities including short-, mid-, and long-term debt. Cash flow from operations is influenced by the profitability of the business of Fresenius and by net working capitalWorking capitalCurrent assets (including deferred assets) - accruals - trade accounts payable - other liabilities - deferred charges., especially accounts receivable. Cash inflow from financing activities is generated from the use of various short-term financing instruments. To this end, we issue commercial paper and draw on bilateral bank credit lines. Short-term liquidity requirements can also be covered by the Fresenius Medical Care accounts receivable securitization program. Medium- and long-term financing is provided mainly by bonds, Schuldschein loans, bilateral credit lines, an equity-neutral convertible bond, and leases. Fresenius is convinced that its existing credit facilities and inflows from further debt financing, as well as the operating cash flows and additional sources of short-term funding, are sufficient to meet the Group’s foreseeable liquidity needs.

Dividend

The general partner and the Supervisory Board will propose a dividend increase to the Annual General Meeting for the 29th consecutive year. Despite the challenging year, this is intended to maintain dividend continuity.

For 2021, a dividend of €0.92 per share is proposed (2020: €0.88 per share). This is an increase of 5%. The total dividend distribution would then also increase by about 5% to €514 million (2020: €491 million).

The Management Board will propose a scrip dividend to the Supervisory Board. The Company wants to give its shareholders the opportunity to opt to receive a portion of the dividend (“Dividend Option Portion”) in Company shares. The remaining portion of the dividend (“Dividend Base Portion”) will always be paid in cash, to ensure that a shareholder does not have to raise any new cash in order to fulfill a possible tax liability with regard to the dividend. In doing so, Fresenius is giving its shareholders an easy and simple way of re-investing their dividend in the Company and strengthening the liquidity for the purpose of further growth financing.

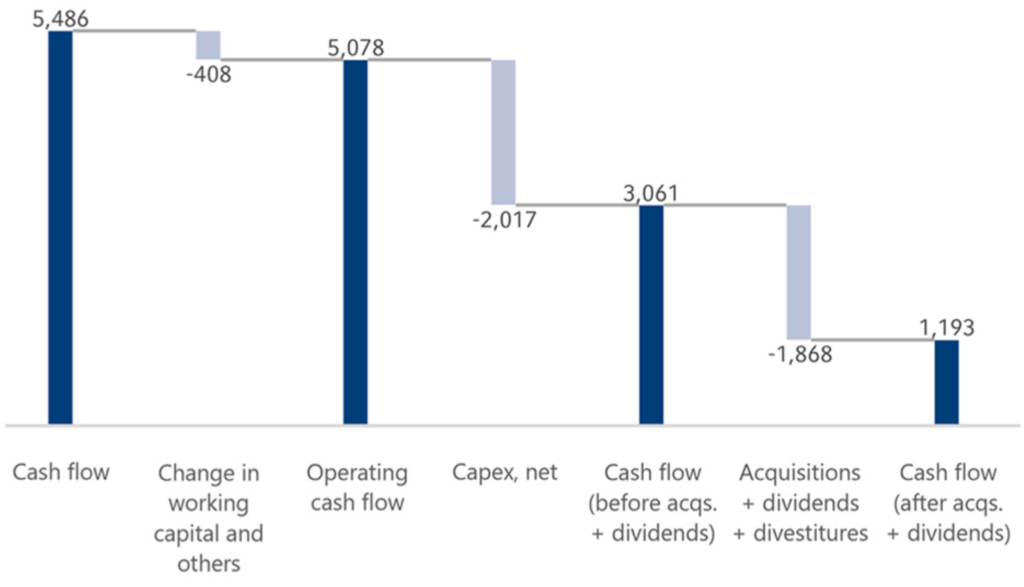

Cash flow analysis

Operating cash flowCash flowFinancial key figure that shows the net balance of incoming and outgoing payments during a reporting period. decreased by 22% to €5,078 million (2020: €6,549 million), with a margin of 13.5% (2020: 18.1%). The cash flow development was mainly due to U.S. government assistance and prepayments under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) at Fresenius Medical Care in the United States.

Cash provided by operating activities exceeded financing needs from investment activities before acquisitions, with cash outflows for capital expenditures amounting to €2,047 million and cash inflows from disposals of noncurrent assets of €30 million (2020: €2,406 million and €40 million, respectively).

Cash flow before acquisitions and dividends was €3,061 million (2020: €4,183 million). This was sufficient to finance the Group dividends of €1,068 million.

cash flow in euro millions

Group dividends consisted of dividend payments of €491 million to the shareholders of Fresenius SE & Co. KGaA, payments of €392 million by Fresenius Medical Care to its shareholders, and dividends paid to third parties of €311 million (primarily relating to Fresenius Medical Care).

These payments were partially offset by the dividend of €126 million that Fresenius SE & Co. KGaA received as a shareholder of Fresenius Medical Care.

The cash outflow for acquisitions was €800 million, mainly for acquisitions at Fresenius Medical Care and Fresenius Helios.

Cash flow after acquisitions and dividends was €1,193 million (2020: €2,478 million).

Overall, cash used for financing activities was €384 million, (2020 cash used for financing activities: €2,057 million). Cash and cash equivalents increased by €927 million to €2,764 million as of December 31, 2021 (December 31, 2020: €1,837 million). Cash and cash equivalents were positively influenced by currency translation effects of €118 million (2020: negative effect of €238 million).

Working capital increased by 7% to €8,690 million, mainly due due to advance payments received from MediCare at Fresenius Medical Care and tax deferrals in North America as a result of COVID-19.

Cash flow statement (summary)

Download(XLS, 35 KB)| € in millions | 2021 | 2020 | Growth | Margin 2021 | Margin 2020 |

|---|---|---|---|---|---|

| Net income | 2,819 | 2,823 | 0% | ||

| Depreciation and amortization | 2,667 | 2,715 | -2% | ||

| Change in working capital and others | -408 | 1,011 | -140% | ||

| Operating cash flow | 5,078 | 6,549 | -22% | 13.5% | 18.1% |

| Capital expenditure, net | -2,017 | -2,366 | 15% | ||

| Cash flow before acquisitions and dividends | 3,061 | 4,183 | -27% | 8.2% | 11.5% |

| Cash used for acquisitions/proceeds from divestitures | -800 | -645 | -24% | ||

| Dividends paid | -1,068 | -1,060 | -1% | ||

| Free cash flow after acquisitions and dividends | 1,193 | 2,478 | -52% | ||

| Cash provided by / used for financing activities | -384 | -2,057 | 81% | ||

| Effect of exchange rates on change in cash and cash equivalents | 118 | -238 | 150% | ||

| Net change in cash and cash equivalents | 927 | 183 | -- |

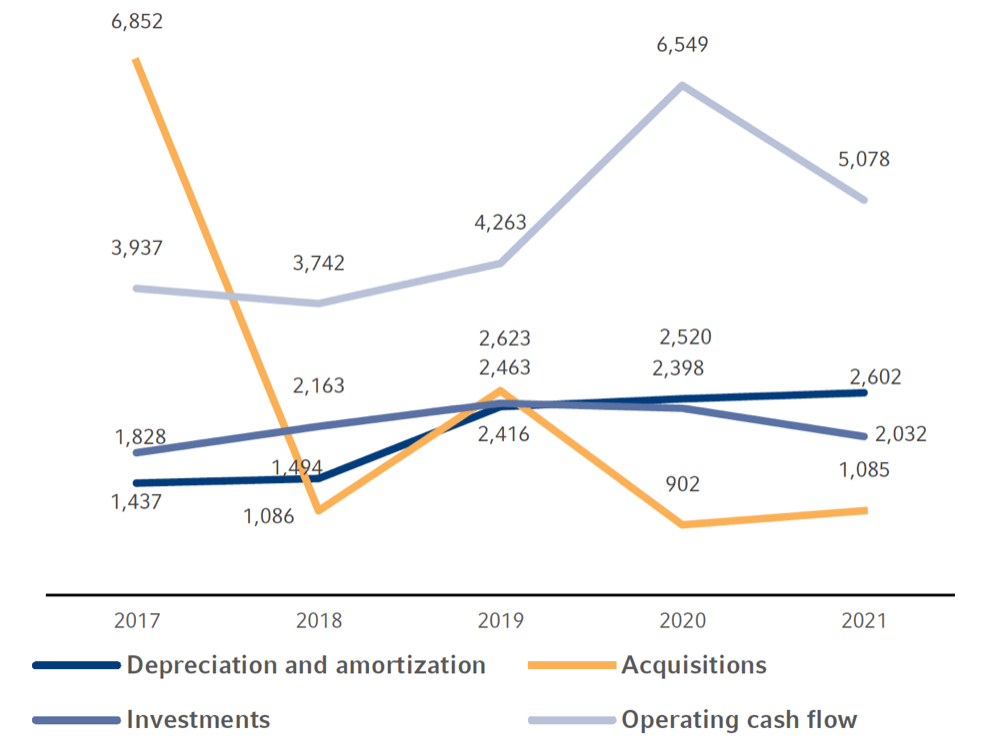

Investments and acquisitions

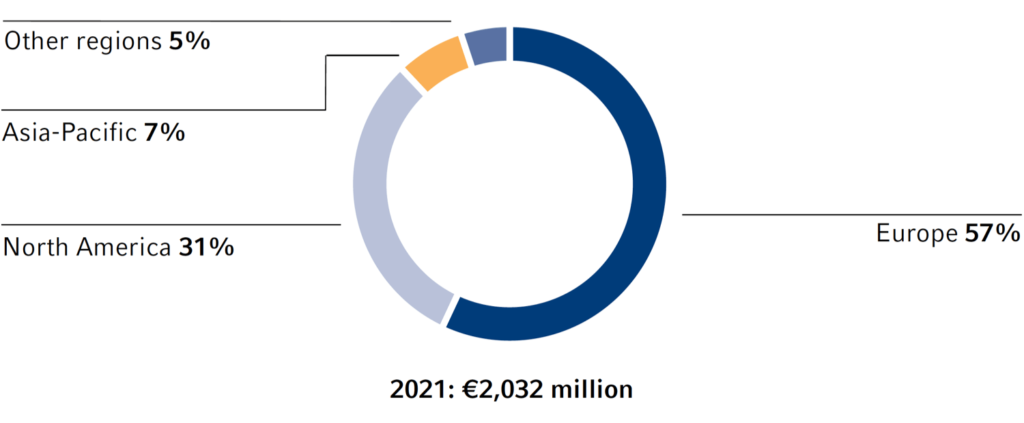

In 2021, the Fresenius Group provided €3,117 million (2020: €3,300 million) for investments and acquisitions. Investments in property, plant and equipment decreased to €2,032 million (2020: €2,398 million). At 5.4% of reported sales (2020: 6.6%), this was below the depreciation level1 of €2,602 million. A total of €1,085 million was invested in acquisitions (2020: €902 million). Of the total capital expenditure in 2021, 65% was invested in property, plant and equipment and 35% was spent on acquisitions.

Investments, acquisitions, operating cash flow, depreciation and amortization in €

1 Before special items

For a detailed overview of special items please see the reconciliation tables in chapter Results of operations.

The cash outflow for acquisitions is primarily related to the following business segments:

- Fresenius Medical Care’s acquisition spending was mainly related to the acquisition of dialysisDialysisForm of renal replacement therapy where a semipermeable membrane – in peritoneal dialysis the peritoneum of the patient, in hemo dialysis the membrane of the dialyzer – is used to clean a patient’s blood. clinics.

- Fresenius Kabi’s acquisition spending was mainly for already-planned acquisition-related milestone payments relating to the acquisition of the biosimilarsBiosimilarsA biosimilar is a drug that is “similar” to another biologic drug already approved. business from Merck KGaA.

- Fresenius Helios’ acquisition spending was mainly for the acquisition of the Eugin Group. Further acquisition expenses related to subsequent purchase price payments for the Malteser-Klinik in Duisburg, Germany, and the acquisition of the DRK-Kliniken Nordhessen in Kassel, Germany.

Investments by region

Investments and acquisitions

Download(XLS, 35 KB)| € in millions | 2021 | 2020 | Change |

|---|---|---|---|

| Acquisitions | 1,085 | 902 | 20% |

| Investment in property, plant and equipment | 2,032 | 2,398 | -15% |

| thereof maintenance | 58% | 49% | |

| thereof expansion | 42% | 51% | |

| Investment in property, plant and equipment as % of sales | 5.4% | 6.6% | |

| Total investments and acquisitions | 3,117 | 3,300 | -6% |

Financial position - Five-year overview

Download(XLS, 35 KB)| in Mio. € | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|

| Operating Cashflow | 5,078 | 6,549 | 4,263 | 3,742 | 3,937 |

| as % of sales | 13.5 | 18.1 | 12.0 | 11.2 | 11.6 |

| Working Capital1 | 8,690 | 8,104 | 8,812 | 7,721 | 7,771 |

| as % of sales | 23.2 | 22.3 | 24.9 | 23.0 | 22.9 |

| Investments in property, plant and equipment, net | -2,017 | 2,366 | 2,433 | 2,077 | 1,705 |

| Cash flow before acquisitions and dividends | 3,061 | 4,183 | 1,830 | 1,665 | 2,232 |

| as % of sales | 8.2 | 11.5 | 5.2 | 5.0 | 6.6 |

Acquisitions at Fresenius Helios

In December 2020, Fresenius Helios announced the acquisition of the Eugin Group, one of the leading international fertility Groups. The Eugin Group has been consolidated since April 1, 2021. The Eugin Group contributed €133 million to sales and €19 million to the operating income (EBITEBIT (Earnings before Interest and Taxes)EBIT does include depreciation and write-ups on property, plant and equipment. EBIT is calculated by subtracting cost of sales, selling, general and administrative expenses, and research and development expenses from sales.) of the Fresenius Group in 2021, with the first-time consolidation as of April 1, 2021.

Eugin’s network comprises 33 clinics and an additional 39 sites across 10 countries on 3 continents and offers a wide spectrum of state-of-the-art services in the field of fertility treatments. The United States, Spain, Brazil, Italy, and Sweden are the Eugin Group’s largest markets. The company also operates clinics in Denmark, Argentina, Colombia, and Latvia.

With the acquisition of the Eugin Group, Fresenius Helios has become a leading player in this dynamic growing market and has established a strong basis for further expansion.

The purchase price is based on a valuation of €430 million, including non-controlling interests acquired and financial liabilities of around €80 million. The non-controlling interests are held by the respective senior physicians.

As of January 1, 2022, the Eugin Group will form a new, separate business and reporting unit within Fresenius Helios, Helios Fertility, alongside Helios Germany and Helios Spain.

On September 2, 2021, Fresenius Helios announced the acquisition of the DRK (German Red Cross) Kliniken Nordhessen. The clinics in Kassel with sites in Kassel-Wehlheiden and Kaufungen with a total of 433 beds as well as an associated outpatient center (MVZ) generated sales of around €87 million in 2020. The DRK-Schwesternschaft remains a co-partner.

Together with the existing Helios hospital in Warburg, North Rhine-Westphalia, a regional medical cluster shall be formed and expanded over the next few years.

The acquisition was completed on September 27, 2021. DRK Kliniken Nordhessen has been consolidated since September 30, 2021. The purchase price amounts to €1 and also includes the assumption of debts and the securing of liquidity for current operations and for future investments.

On November 22, 2021, Quirónsalud, Spain’s largest private hospital operator, owned by Fresenius Helios, announced the acquisition of the specialty hospitals Centro Oncológico de Antioquia (COA) and Clínica Clofán. The clinics, located in Colombia’s second largest city, Medellín, will become part of Quirónsalud’s existing health care network in the country, which already comprises 6 hospitals and 10 diagnostic centers.

COA is specialized in the diagnosis and treatment of cancer. It has 75 beds, 4 operating rooms, and specialized centers for nuclear medicine, radiotherapy, and bone marrow transplants.

Clínica Clofán is the second largest ophthalmic center in the city, with 10 operating rooms and further dedicated facilities for treating even severe ophthalmic diseases and performing complex procedures. Both clinics offer state-of-the-art medical standards and technology to their patients and are regarded as leading medical facilities with highly renowned physicians. Together, they generate sales of around €30 million.

The acquisition is another important step to strengthen Fresenius Helios’ presence in the growing and consolidating health care services markets in Latin America.

The transaction is expected to close in the first quarter of 2022, pending anti-trust clearance from the Colombian authorities. Fresenius Helios expects the acquisition to be accretive to Fresenius’ Group net income as early as fiscal year 2022.

The main investments in property, plant and equipment were as follows:

- modernization of existing, and equipping of new, dialysis clinics at Fresenius Medical Care.

- optimization and expansion of production facilities for Fresenius Medical Care and for Fresenius Kabi.

- new building and modernization of hospitals at Fresenius Helios. The most significant individual projects were, among other locations, hospitals in Wiesbaden, Duisburg, Wuppertal, Niederberg and investments in IT infrastructure.

Investments in property, plant and equipment of €277 million will be made in 2022, to continue with major ongoing investment projects on the reporting date. These are investment obligations mainly for investments to expand and optimize production facilities for Fresenius Medical Care and Fresenius Kabi. These projects will be financed from operating cash flow.

Investment program at Fresenius Kabi

Fresenius Kabi has a global network of production centers. We manufacture our products in our plants and, at some sites, we also produce pharmaceutical raw materials. With our investments we aim, among other things, to continuously modernize and automate as well as increase the competitiveness of the plants at a consistently high level of quality. At the same time, we are responding to the increased demand for our products, for example, by expanding our sites.

In the United States, Fresenius Kabi continued its extensive investment program at the manufacturing sites. In 2021, we made progress with our investment program and continued equipping our plants with the latest technologies for the production of pharmaceutical products. Fresenius Kabi will continue its investment program in the United States in the coming years.

Due to the demand for enteral products in China, we are expanding our production capacity there. In 2021, we continued work on a new production building on our campus in Wuxi. In the future, we will be producing enteral nutrition products there that have the status of Foods for Special Medical Purposes. Fresenius Kabi will also be expanding its research and development activities for enteral nutritionEnteral nutritionApplication of liquid nutrition as a tube or sip feed via the gastrointestinal tract. at the Wuxi site.

In Austria, we continued to expand our production and logistics site in Graz. With capital expenditure of around €110 million, we will continue to expand this site in the next few years.

The plant manufactures sterile drugs such as intravenously administered drugs and large-volume products for parenteral nutrition; the site also specializes in complex process requirements and innovative technologies. The focus is on freeze-drying and systems for filling and packaging glass bottles and prefilled syringes. The demand for prefilled syringes is increasing, as they offer significant advantages in everyday clinical life thanks to their fast and safe application.

In the manufacturing plant, the mobile preparatory area will be enlarged, freeze-drying (lyophilization) expanded, and new filling systems implemented. The completion of the expansion work is planned for 2023. In 2021, we inaugurated the new packaging building at our logistics site in Werndorf, near Graz.

In France, we began with the modernization of the plant at our Louviers production site. Over the next two years, a new building comprising an area of 3,300 square meters will be set up in the production facilities for freeflex infusion bags. This also allows the European production network to be optimized as a whole. In total, we will be investing €35 million in the modernization.

Our Haina plant in the Dominican Republic is the central manufacturing facility for disposable products in the field of apheresis and cell therapy. Driven by the high market demand for plasma products and cell therapies, we have gradually expanded the plant in recent years. In the plasma collection business, in addition to disposable products for our Aurora plasmapheresis system, the disposable products of the successor system, Aurora Xi, are also produced in Haina. We are also currently in the process of relocating the production of disposable products for autotransfusion to Haina.

In order to continue to meet the growing market demand for these disposable products, we will be expanding our manufacturing plant in the coming years with highly automated production facilities and clean-room capacities. In total, we will invest more than €65 million in the Haina plant by 2024.

Investments and acquisitions by business segment

Download(XLS, 35 KB)| € in millions | 2021 | 2020 | Thereof property, plant and equipment |

Thereof acquisitions |

Change | % of total |

|---|---|---|---|---|---|---|

| Fresenius Medical Care | 1,482 | 1,459 | 854 | 628 | 2% | 47% |

| Fresenius Kabi | 533 | 718 | 532 | 1 | -26% | 17% |

| Fresenius Helios | 1,021 | 1,000 | 568 | 453 | 2% | 33% |

| Fresenius Vamed | 81 | 101 | 80 | 1 | -20% | 3% |

| Corporate / Other | 0 | 22 | -2 | 2 | -100% | 0% |

| Total | 3,117 | 3,300 | 2,032 | 1,085 | -6% | 100% |