Fresenius Helios is Europe’s largest private hospital operator, offering expertise in all areas and at all levels of inpatient and outpatient care as well as state-of-the-art services in the field of fertility treatments. Fresenius Helios carries responsibility for over 22 million patients who undergo medical treatment with it every year.

Major events

Positive development in case numbers over the course of the year.

In view of the trend towards digital and outpatient services, as well as increasing COVID-19 cases once again towards the end of the year, the overall number of cases in Germany was 2% below pre-pandemic levels. We recorded sustained high demand for treatments as well as for services for occupational risk prevention (ORP) in Spain, in addition to good contributions from our hospitals in Latin America.

Cluster strategy driven forward with the acquisition of two hospitals in northern Hesse.

Together with the existing Helios site in Warburg in North Rhine-Westphalia, the aim is to form and expand a regional network over the next few years.

Hospital in Volkach sold.

The transaction is a first result of the ongoing strategic review and optimization of Helios’ hospital portfolio in Germany.

Digital services expanded.

Important health parameters of cardiology patients can be tracked via our platform Curalie. We have also expanded the scope of our telemedicine offerings, both regionally and to additional indications. In Spain, we performed more than one million digital consultations with our doctors in 2021.

Growth opportunities in the field of fertility treatments exploited.

We have acquired leading reproductive clinics and centers in the United States and Canada, and opened a new reproductive medicine facility in Vicenza, Italy.

Comprehensive inpatient and outpatient care

Fresenius Helios comprises Helios Germany and Helios Spain (Quirónsalud) as well as Eugin Group; all are part of the holding company Helios Health.

Our extensive expertise and know-how in ensuring high-quality, efficient, and patient-focused health care are exchanged across borders. This mutual knowledge transfer aims to continuously optimize the care of our patients.

Helios Germany operates 90 hospitals, around 130 outpatient clinics, and 6 prevention centers. It is the largest provider of inpatient and outpatient care in Germany.

Quirónsalud operates 56 hospitals, 88 outpatient centers, and around 300 occupational risk prevention centers. It is the largest private hospital operator in Spain. The company offers comprehensive health care that encompasses all medical specialties. In addition, the company is active in Latin America with 7 hospitals and as a provider of medical diagnostics.

Eugin Group’s network comprises 33 clinics and additional 39 sites across 10 countries on 3 continents. The company offers a wide spectrum of state-of-the-art services in the field of fertility treatments.

The platform Curalie bundles the digital offerings of Fresenius Helios. Curalie’s support tools are specifically designed to treat chronically ill patients.

Our success factors

- Focus on patients’ safety and satisfaction

- Leading market positions

- Achieving measurable, high-quality standards of medicine

- Future-oriented workplace

- Strong hospital network and development of centers of excellence

- Digital support tools for patient treatment

Our growth drivers

- Organic growth through growing patient admissions and increasing prices for hospital services

- Growth opportunities in the outpatient sector and development of new patient care models

- Expanding fertility services

- Increasing digital connectivity with patients

- Carrying out greenfield projects

- Providing development opportunitiesfor doctors and nurses

- Selective inorganic growth

Market dynamics

Inpatient treatments could be performed in outpatient settings in

25%

of cases.

An increased focus on ambulatory care offers opportunities for hospital operators.

Average increase of private health insurance policies in Spain of

~2.5% p.a.

Hospital market in Germany

~ € 111bn

Private hospital market in Spain

~ € 16 bn

Downloads of e-health apps in Germany increased in 2020 to

2 million.

As a result of the COVID-19 pandemic, they doubled compared to the previous year.

The most common positive benefit with e-health applications is with improved health status, for

~75%.

Higher cost efficiency and time savings are next, some distance behind.

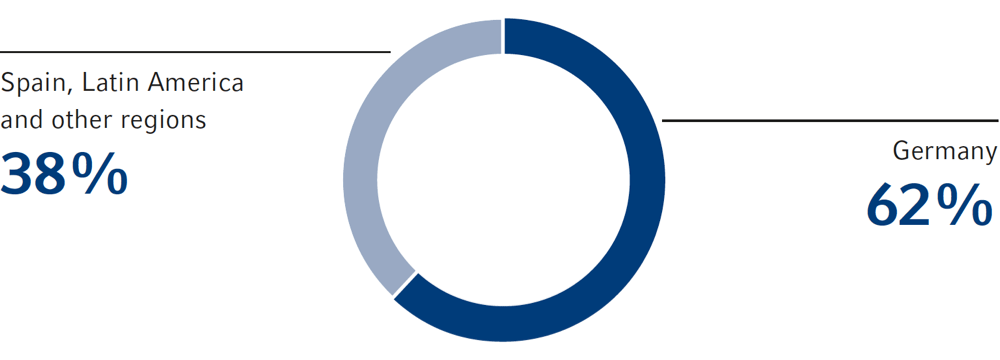

Sales by region

Key Hospital indicators

Download(XLS, 35 KB)| 2021 | 2020 | Change | |

|---|---|---|---|

| Acute clinics Germany | 87 | 86 | 1% |

| Beds | 29,955 | 29,451 | 2% |

| Acute clinics Spain and Latin America | 56 | 52 | 8% |

| Beds | 8,174 | 7,936 | 3% |

| Patient numbers Germany | 5,444,546 | 5,151,717 | 6% |

| Patients treated in hospital | 1,048,946 | 1,044,959 | 0% |

| Patients treated as outpatients | 4,390,553 | 4,101,716 | 7% |

| Patient numbers Spain and Latin America | 17,122,592 | 15,037,804 | 14% |

| Patients treated in hospital | 982,204 | 927,414 | 6% |

| Patients treated as outpatients | 16,140,388 | 14,110,390 | 14% |

Sales and earnings development

Helios Spain

Download(XLS, 35 KB)| in € millions | 2021 | 2020 | Change | Change in constant currency |

|---|---|---|---|---|

| Sales | 4,021 | 3,475 | 16% | 17% |

| EBIT | 514 | 420 | 22% | 24% |

| Employees | 47,332 | 43,195 | 10% |

Helios Germany

Download(XLS, 35 KB)| in € millions | 2021 | 2020 | Change | Change in constant currency |

|---|---|---|---|---|

| Sales | 6,733 | 6,340 | 6% | 6% |

| EBIT | 613 | 602 | 2% | 2% |

| Employees | 75,459 | 73,757 | 2% |

Fertility services

Download(XLS, 35 KB)| in € millions | 2021 |

|---|---|

| Sales | 133 |

| EBIT | 19 |

| Employees | 1,629 |

Sources:

Inpatient treatments could be performed in outpatient settings in 25% of cases.

Source: Bertelsmann Stiftung, Spotlight Gesundheit, 2019, Ärztliche Vergütung

Hospital market in Germany ~ € 111 bn

Source: German Federal Statistical Office, 2019 data (most recent market data available refers to the year 2019 as no more recent data has been published); own research Helios Germany

Downloads of e-health apps

Source: McKinsey & Company, eHealth Monitor 2020

Average increase of private health insurance policies in Spain of ~ 2.5% p.a.

Source: Asociación ICEA (Investigación Cooperativa entre Entidades Aseguradoras y Fondos de Pensiones), data from 2011 to 2019

Private hospital market in Spain ~ € 16 bn

Source: market data based on own research and refers to the addressable market for Quirónsalud.

Most common positive benefit for e-health applications.

Source: McKinsey & Company, eHealth Monitor 2020