Fresenius is a global healthcare Group in the legal form of an SE & Co. KGaA (a partnership limited by shares). We offer products and services for dialysisDialysisForm of renal replacement therapy where a semipermeable membrane – in peritoneal dialysis the peritoneum of the patient, in hemo dialysis the membrane of the dialyzer – is used to clean a patient’s blood., hospitals, and outpatient medical care. In addition, Fresenius focuses on hospital operations. We also manage projects and provide services for hospitals and other healthcare facilities worldwide.

Group structure

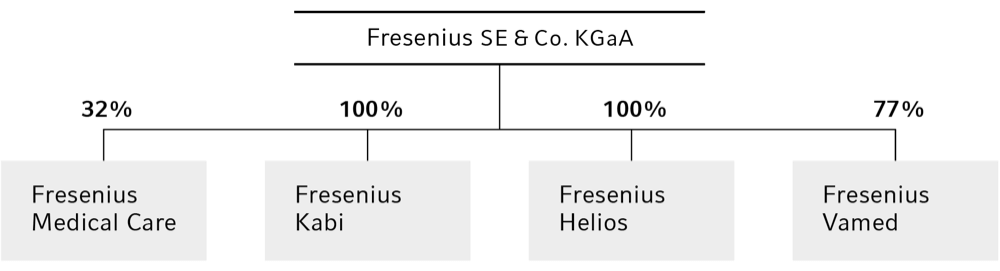

The operating business comprises four business segments, all of which are legally independent entities and have a decentralized structure, managed by the operating parent company Fresenius SE & Co. KGaA.

There were no changes to the Group’s business model in 2022.

As part of the strategic review of the Fresenius Group, we will distinguish between the operating companies Fresenius Kabi and Fresenius Helios (each with 100% ownership share) and the investment companies Fresenius Medical Care (32% ownership share) and Fresenius Vamed (77% ownership share) as of the reporting year 2023.

For the Operating Companies, the focus is on profitability optimization and growth. For the Investment Companies, the focus is on financial value management. Fresenius SE & Co. KGaA is the largest shareholder of Fresenius Medical Care & Co. KGaA. The business segment Fresenius Medical Care is fully consolidated in the consolidated financial statements of the Fresenius Group in accordance with IFRS 10. Fresenius intends to deconsolidate the business segment Fresenius Medical through a change of legal form of Fresenius Medical Care AG & Co. KGaA into a stock corporation (Aktiengesellschaft). The change of legal form shall take effect in the course of the year subject to the required approval of the General Meeting of Fresenius Medical Care AG & Co. KGaA and the registration in the commercial register. For this purpose, an extraordinary General Meeting of Fresenius Medical Care AG & Co. KGaA will decide on the proposal for the change of legal form into a stock corporation (Aktiengesellschaft). As a result of the planned measure, Fresenius Medical Care will no longer be part of the fully consolidated subsidiaries of Fresenius. Fresenius´ share in the subscribed capital of Fresenius Medical Care AG & Co. KGaA in the amount of 32% will remain unaffected by the change of legal form.

- Fresenius Medical Care offers services and products for patients with chronic kidney failure. As of December 31, 2022, Fresenius Medical Care treated 344,687 patients at 4,116 dialysis clinics. Dialyzers and dialysis machines are among the most important product lines. In addition, Fresenius Medical Care offers dialysis-related services.

- Fresenius Kabi specializes in products for the therapy and care of critically and chronically ill patients. The portfolio includes biopharmaceuticals, clinical nutrition, MedTech products, intravenously administered generic drugs (generic IV drugs), and IV fluids.

- Fresenius Helios is Europe’s leading private hospital operator. Under the holding Helios Health, the company includes Helios Germany, Helios Spain (Quirónsalud), and the Eugin Group. At the end of 2022, Helios Germany operated a total of 87 hospitals, around 240 outpatient clinics, 6 prevention centers and 21 occupational health centers. In Spain, Quirónsalud operated 50 hospitals, around 100 outpatient centers, and around 300 occupational risk prevention centers at the end of 2022. In addition, Helios Spain is active in Latin America with 8 hospitals as well as a provider of medical diagnostics. The Eugin Group’s network comprises 44 clinics and additional 37 sites across 10 countries on 3 continents. Eugin offers a wide spectrum of state-of-the-art services in the field of fertility treatments.

- Fresenius Vamed manages projects and provides services for hospitals as well as other healthcare facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management. The services are aimed at various areas of healthcare, ranging from prevention and acute care to rehabilitation and nursing.

Fresenius has an international revenue network and maintains more than 90 production sites. Large production sites are located in the United States, China, Japan, Germany, and Sweden.

Important markets and competitive position

Fresenius operates in more than 90 countries through its subsidiaries. The main markets are Europe with 44% and North America with 40% of revenue, respectively.

Fresenius Medical Care holds the leading position worldwide in dialysis care, as it serves about 9% of all dialysis patients, as well as in dialysis products, with a market share of about 35%.

Fresenius Kabi is one of the leading companies in Europe for large parts of its product portfolio and has significant market shares in the growth markets of Asia-Pacific and Latin America. Furthermore, Fresenius Kabi is one of the leading companies in the field of generic IV drugs both in the U.S. market and in Europe.

Fresenius Helios is Europe’s leading private hospital operator. Helios Germany and Helios Spain are the largest private hospital operators in their respective home markets. The Eugin Group is a leading international provider in the field of fertility services.

Fresenius Vamed is a global company with no direct competitors covering a comparably comprehensive portfolio of projects, services, and total operational management over the entire life cycle of healthcare facilities. In Central Europe, the company is one of the leading private providers of rehabilitation services. As a result, Fresenius Vamed has an unique selling proposition of its own. Depending on the business segment, the company competes with international companies and consortia, as well as with local providers.

External factors

The war in Ukraine had a negative impact on the Fresenius Group’s business, both directly and indirectly. The negative impact amounted to €43 million in net income1 in 2022.

In fiscal year 2022, the difficult macroeconomic environment had a negative impact on business development. This included increased uncertainties, inflation-related cost increases, staff shortages, supply chain disruptions, the continued impact of the COVID-19 pandemic, and increased energy costs. This had a direct impact on customer and patient behavior. Despite the challenging market environment, the structural growth drivers in the non-cyclical healthcare markets are in place. We report on our markets in the chapter Healthcare industry. We report on the impact of rising energy prices on business performance as well as on the new aid payments in the hospital business in the section The hospital market.

The legal framework for the operating business of the Fresenius Group remained essentially unchanged in 2022.

Fluctuating exchange rates, particularly between the U.S. dollar and the euro, have an effect on the income statement and the balance sheet. In 2022, the average annual exchange rate between the U.S. dollar and the euro of 1.05 was below the 2021 rate of 1.18, and therefore had a positive currency translation effect on the income statement. Details of this can be found in the statement of comprehensive income.

While the balance sheet total increased by 6%, the increase in constant currency was only 4%, in particular due to the exchange rate changes (from 1.13 U.S. dollars on December 31, 2021, to 1.07 U.S. dollars on December 31, 2022).

In 2022, the Fresenius Group was involved in various legal disputes resulting from business operations. Although it is not possible to predict the outcome of these disputes, none is expected to have a significant adverse impact on the assets and liabilities, financial position, and results of operations of the Group.

We carefully monitor and evaluate country-specific political, legal, and financial conditions. This also applies to the potential impact on our business that could result from inflation risks.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Management and control

In the legal form of a KGaA, the Company’s corporate bodies are the Annual General Meeting, the Supervisory Board, and the general partner, Fresenius Management SE. Fresenius Management SE is wholly owned by Else Kröner-Fresenius-Stiftung. The KGaA has a two-tier management system – management and control are strictly separated.

The general partner, represented by its Management Board, conducts the business and represents the Company in dealings with third parties. The Management Board generally has seven members. According to the Management Board’s rules of procedure, each member is accountable for his or her own area of responsibility. However, the members have joint responsibility for the management of the Group. In addition to the Supervisory Board of Fresenius SE & Co. KGaA, Fresenius Management SE has its own Supervisory Board. The Management Board is required to report to the Supervisory Board of Fresenius Management SE regularly, in particular on its corporate policy and strategies. In addition, the Management Board reports on business profitability, current operations, and any other matters that could be of significance for the Company’s profitability and liquidity. The Supervisory Board of Fresenius Management SE also advises and supervises the Management Board in its management of the Company. It is prohibited from managing the Company directly. However, the Management Board’s rules of procedure require it to obtain the approval of the Supervisory Board of Fresenius Management SE for specific activities.

The members of the Management Board are appointed and dismissed by the Supervisory Board of Fresenius Management SE. Appointment and dismissal is in accordance with Article 39 of the SE Regulation1. The articles of association of Fresenius Management SE also provide that deputy members of the Management Board may be appointed.

The Supervisory Board of Fresenius SE & Co. KGaA advises on and supervises the management of the Company’s business by the general partner, reviews and approves the annual financial statements and the consolidated financial statements, and performs the other functions assigned to it by law and the Company’s articles of association. It is involved in corporate planning and strategy, and in all matters of fundamental importance for the Group. The Supervisory Board of Fresenius SE & Co. KGaA has six shareholder representatives and six employee representatives. A Nomination Committee of the Supervisory Board of Fresenius SE & Co. KGaA has been instituted for election proposals for the shareholder representatives. Its activities are aligned with the provisions of law and the Corporate Governance Code. The shareholder representatives are elected by the Annual General Meeting of Fresenius SE & Co. KGaA. The European works council elects the employee representatives to the Supervisory Board of Fresenius SE & Co. KGaA.

The Supervisory Board must meet at least twice per calendar half-year. The Supervisory Board of Fresenius SE & Co. KGaA has two permanent committees: the Audit Committee, consisting of five members, and the Nomination Committee, consisting of three members. The Company’s annual corporate governance declaration pursuant to Section 315d and Section 289f of the German Commercial Code (HGB) describes the procedures of the Supervisory Board’s committees. The declaration can be found on the website www.fresenius.com/corporate-governance.

The description of both the compensation system and individual amounts paid to the Management Board and Supervisory Board of Fresenius Management SE, and the Supervisory Board of Fresenius SE & Co. KGaA, are included in the Compensation Report of this Group Annual Report.

1 Council Regulation (EC) No. 2157 / 2001 of October 8, 2001 on the Statute for a European Company (SE) (SE Regulation - SE-Reg)

Capital, shareholders, articles of association

The subscribed capital of Fresenius SE & Co. KGaA amounted to 563,237,277 ordinary shares as of December 31, 2022 (December 31, 2021: 558,502,143).

The shares of Fresenius SE & Co. KGaA are non-par-value bearer shares. Each share represents €1.00 of the capital stock. Shareholders’ rights are regulated by the German Stock Corporation Act (AktG – Aktiengesetz) and the articles of association.

Fresenius Management SE, as general partner, is authorized, subject to the consent of the Supervisory Board of Fresenius SE & Co. KGaA: to increase the subscribed capital of Fresenius SE & Co. KGaA by a total amount of up to €125 million, until May 12, 2027, through a single issuance or multiple issuances of new bearer ordinary shares against cash contributions and / or contributions in kind (Authorized Capital I). In principle, the shareholders shall be granted a subscription right. In certain cases, however, the right of subscription can be excluded.

In addition, there are the following Conditional Capitals according to the articles of association of July 6, 2022:

- The subscribed capital is conditionally increased by up to €4,735,083.00 through the issuance of new bearer ordinary shares (Conditional Capital I). The conditional capital increase will only be executed to the extent that convertible bonds for ordinary shares have been issued under the 2003 Stock Option Plan and the holders of these convertible bonds exercise their conversion rights. Following the expiry of the 2003 Stock Option Plan in 2018, Conditional Capital I is no longer used.

- The subscribed capital is conditionally increased by up to €3,452,937.00 through the issuance of new bearer ordinary shares (Conditional Capital II). The conditional capital increase will only be executed to the extent that subscription rights have been issued under the 2008 Stock Option Plan, the holders of these subscription rights exercise their rights, and the Company does not use its own shares to service the subscription rights or does not exercise its right to make payment in cash. Following the expiry of the 2008 Stock Option Plan in 2020, Conditional Capital II is no longer used.

- The general partner is authorized, with the approval of the Supervisory Board, until May 12, 2027, to issue option bearer bonds and / or convertible bearer bonds, once or several times. To fulfill the granted subscription rights, the subscribed capital of Fresenius SE & Co. KGaA was increased conditionally by up to €48,971,202.00 through issuance of new bearer ordinary shares (Conditional Capital III). The conditional capital increase shall only be implemented to the extent that the holders of convertible bonds issued for cash, or of warrants from option bonds issued for cash, exercise their conversion or option rights and as long as no other forms of settlement are used.

- The share capital is conditionally increased by up to €22,824,857.00 by the issuance of new ordinary bearer shares (Conditional Capital IV). The conditional capital increase will only be implemented to the extent that subscription rights have been, or will be, issued in accordance with the Stock Option Program 2013 and the holders of subscription rights exercise their rights, and the Company does not grant its own shares to satisfy the subscription rights.

The Company is authorized, until May 12, 2027, to purchase and use its own shares up to a maximum amount of 10% of the subscribed capital. In addition, when purchasing its own shares, the Company is authorized to use equity derivatives with possible exclusion of any tender right. The Company had not utilized these authorizations as of December 31, 2022.

As the largest shareholder, Else Kröner-Fresenius-Stiftung, Bad Homburg, Germany, informed the Company on December 15, 2022, that it held 151,842,509 ordinary shares of Fresenius SE & Co. KGaA. This corresponds to an equity interest of 27.0% as of December 31, 2022.

Amendments to the articles of association are made in accordance with Section 278 (3) and Section 179 (2) of the German Stock Corporation Act (AktG) in conjunction with Article 17 (3) of the articles of association of Fresenius SE & Co. KGaA. Unless mandatory legal provisions require otherwise, amendments to the articles of association require a simple majority of the subscribed capital represented in the resolution. If the voting results in a tie, a motion is deemed rejected. Furthermore, in accordance with Section 285 (2) sentence 1 of the German Stock Corporation Act (AktG), amendments to the articles of association require the consent of the general partner, Fresenius Management SE. The Supervisory Board is entitled to make such amendments to the articles of association that only concern their wording without a resolution of the Annual General Meeting.

Under certain circumstances, a change of control would impact our major long-term financing agreements, which contain customary change of control provisions that grant creditors the right to request early repayments of outstanding amounts in case of a change of control. The majority of our financing arrangements, in particular our bonds placed in the capital markets, however, require that the change of control is followed by a decline or a withdrawal of the Company’s rating or that of the respective financing instruments.